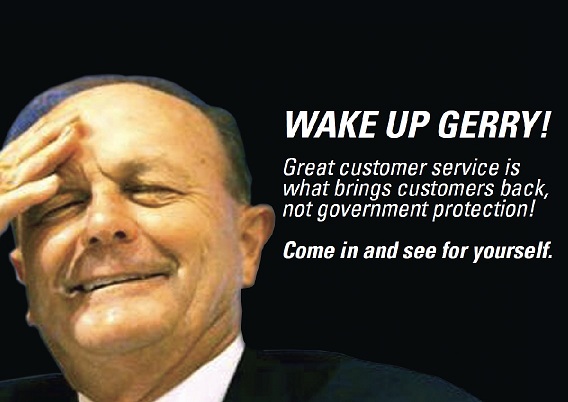

The marketing team at my newsagency software company Tower Systems has produced three posters newsagents could use in response to Gerry Harvey’s shrill about online shopping. Click on the links to access the three posters in PDF form: Gerry, Gerry2 and Gerry3. The posters have been created to tap into public interest in this issue as well as to remind shoppers that in businesses showing the posters customer service matters.

The marketing team at my newsagency software company Tower Systems has produced three posters newsagents could use in response to Gerry Harvey’s shrill about online shopping. Click on the links to access the three posters in PDF form: Gerry, Gerry2 and Gerry3. The posters have been created to tap into public interest in this issue as well as to remind shoppers that in businesses showing the posters customer service matters.

I hope that people embrace them with the humor with which they have been created.

Sounds a bit tall poppyish for me… if there was someone running our representative bodies who was 1/10 as smart,clever, retail savy and focussed on retail and committed to his business model as Gerry is we would be 100 times better off,he did start with just one store and a old and broken retail model…sound familiar

Helen,

Many would say that over the last few years Gerry has lost his touch. Australians are consuming vastly more electronics than ever before. Gerry should be rolling in cash because this. He isn’t. Some would also say his current business model is breaking.

The Fin Review on the weekend offered some good reporting on the GST story and Gerry Harvey’s missteps in particular.

Jarryd,

im not too sure how much cash you need to be “rolling in it ” as you say but $1.3 billion (according to the latest brw list ) ought to do the trick…

btw i dont know too many newsagents worth $1.3 billion either….if thats a broken model then id love to see the unbroken one

I love Gerry Harvey.

If I was available and he was too I would pursue him.

He is funny, smart,

savvy, kind (did anyone see the fellow on Australian story that Gerry supported

with huge sums of money to create better soils and water drainage etc when no government officials or mps would listen.

I found it (and Gerry) quite mesmerizing and I agree with Helen that we could do with his model and then some in our retail stores.

I can’t stand the whining/whingeing tone to his voice and I don’t think I’m alone. He has, in my opinion made a major blunder with this issue and is perhaps not as aware as he should be about the growth of online retailing. For those reasons he has made himself a target and if I were one of his franchisees I probably wouldn’t be too happy with the current plublicity either.

Notwithstanding the above he is without doubt one of the best retailers this country has ever seen. I’m not particularly fond of his stores but it’s a great place to start shopping and comparing prices and stock even with the full knowledge that I can purhcase it elsewhere cheaper which I probably will but a lot of don’t go out his door without a purchase. Good on him for that and for accomplishing far more than I could ever imagine achieving.

He remains a great retailer who has made a fairly bad call on this issue and should let it rest.

Helen,

I was refering to the last few years, as the consumption of electronics has grown exponentially and Harvey Norman stores have not. Other tech retailers who are based online are doing far better at present. His failed Ofis concept is but another example of a once savvy, ahead-of-the-game retailer who cant keep up.

Gerry has the resources to take on the internet market. But he clearly doesnt understand it enough to do so.

Gerry has been around for more then a few decades and has made enough money from all his projects for others to take him seriously, I and others including yourself Jarryd can only dream of having his wealth and business knowledge.

If you are so intune with the online trend why not leave your current employer and show others how it is done. It is easy to sit on the sidelines and throw stones.

i am not a Harvey Norman fan but to say he is not up to speed shows little knowledge of how wide his net is.

Luke,

I dont profess to have the knowledge (or the capital and market reach the Gerry has) to move into the online retailing space.

Online retailers are powering ahead with huge growth while the traditional store-front retailers, of which Gerry is but one, refuse to enter the space competitively.

Call my comments stone-throwing if you like. It doesnt make the facts any less true.

you seem to be very selective in what you call facts Jarryd, time is the best indicator of what is fact or just hype and Harvey Normans has been around as others have come and gone.

I do not need to defend Gerry Harvey only to say to those that have jumped in recently and put the boot in, if you do not like what he has done and think you can do it better then off you go. He started from scratch so there is no reason you cannot outdo his ” broken model”.

Luke,

It is a fact that Gerry and almost all major store-front retailers have not entered the online space competitively.

It is a fact that despite mamoth growth in consumer electronic sales Gerry Harvey, and many of his store-front retailers, are loosing notable market share to online retailers.

Industry commentators arent just putting the boot into Gerry, they’re putting it into all the major retailers that aren’t moving into the online space (or at the very least overhauling their existing models) in a competative way.

i love ebay. i do buy everything now from ebay. can you buy ipod charger for $1 incl. postage in australia????

Is is also a fact that Australian retailers have to charge GST on ALL online sales whereas overseas retailers do not for purchases under $1000, is this not what the whole thing is about?

10 yrs ago the computer section of Harvey normans was small, no it takes up a large chunck of the shops but that is not to say that it is the be all and end of of their business, just like mags are not the be all and end all our ours.

While major retailers lose market share in one department they make it up in others,

don’t be too short sighted to think they have thrown all their eggs into the tech basket just like we should not rely on print to keep newsagencies in the marketplace.

Luke,

One can’t electronics and magazines. One market is growing fast, the other shrinking. No one is going to put all their eggs in the magian basket because the outlook for the future is clear – magazines are on a permanent decline. Conversely, consumer electronics and computers are on a clear upward trend that isn’t going to change anywhere in the foreseable future.

This is the department of Harvey Norman most likely to be under threat from online sales.

Last year was certainly not the best for those with shares in the retailer.

Again, it is unlikely that introducing GST would do anything to slow consumers importing from overseas. The federal government has even raised the concern that it could actually cost more to administer than any revenue raised. So who wins from a situation where GST is charged on imports under $1000? No one.

The fact that Gerry and other major retailers are calling for GST on imports under $1000 shows they don’t understand why their customers are leaving them.

So, what’s the alternative? Move offshore & play the same game?

Another great idea for Australia & jobs.

The fact is it is an unfair playing field because of the costs involved with retail in relation to online selling. I can see where Gerry is coming from, but his communication has come across all wrong on this one.

Bring back the tariff?

Just a thought.

Max,

There are plenty of online retailers based in Australia who are doing very well. You don’t have to move offshore to be competitive.

The keys to creating an online business are the same as bricks and mortar – find a need and fill it. The difference is that the world is your marketplace online whereas in the bricks and mortar world your reach is more local.

that said, there are excellent opportunities for customer centric retailers to grow in the current marketplace – look at the customer service backlash against Gerry harvey.

Jarryd you are stating the bleeding obvious.

That is not the point to this discussion.

It is an unfair playing arena as it stands.

Something needs to be done in regard to the imports below the $1000. Other countries have measures in place. What is wrong with our pollies?

If you think that we can match overseas countries with the cost of products, then get ready to adapt to their living standards.

Max,

Yes, I am stating the obvious. Apparently it needs to be stated.

You say “something needs to be done in regards to the imports below the $1000”. Why? What is the “unfair playing arena”?

I’m not sure how consumers paying less for products translates to reduced living standards. In fact I’m sure it would lead to the exact opposite.

I think what a few of the commenters are missing is this the serious critics, including Jarryd and Mark, are making the point that markets are changing and the GST is a side issue to much bigger trends.

While everyone agrees there should be a level field, the problems of Harvey Norman, Coles and many other retailers is about their failures to understand the threats and opportunities in the changing economy.

Mark has been exploring exactly that issue on this blog with his posts on the newsagency of the future.

One area the big retailers have really fallen down on in recent years has been customer service, the best thing smaller retailers like newsagents can do is beat the big boys on providing a smile and informed, friendly advice.

The real lesson from the “Fair Go for Retail” is how out of touch the supposed leaders of the Australian retail industry are with their customers.

That is a real opportunity for the smart newsagent and anyone else in retail.

Jarryd….get the blinkers off.

The exact opposite? You really are a comedian.

If I have to explain every single point to you after what has been said here you obviously will never see the problem that exists.

There are two elements to this discussion:

1. That GST is not paid on billions of dollars of spending instituted from within Australia.

2. That bricks and mortar retailers are struggling to compete with online businesses.

You can’t protect retailers by chasing the GST issue. Indeed, I doubt that even addressing the GST issue would slow online spending with overseas retailers.

Whether we like it or not, we live in a more borderless economy than ever before. I doubt that any government would have an appetite for winding back to pre-globalisation days.

So, we have to get with it and either compete based on our strengths as bricks and mortar retailers or get smart online, or both of course.

The GST campaign waged by Gerry Harvey and now others is a sideshow to the real game. Failure by any retailer to understand this will lead to failure in the future.

Max,

If you cant detail what the problem you perceive there to be, I can only assume that there isn’t one.

If consumers pay less for product then they have more money left over. Disposable income that stretches further will naturally lead to an increased standard of living.

I don’t think Gerry will be too unhappy with his lower tech/type sales when he sees his whitegoods and furniture sales after the floods subside. The insurance money should keep him well in front in sales for a long time yet. It is sad to admit but one man’s meat is another man’s poison

I don’t think he would rejoice in the hardship in Qld but he will surely profit from the same.

Its a good thing you do not own a business Jarryd, as you seem to think tax is not overly important thing, as long as people pay less then they will have more to spend? You seem to miss the whole GST issue.

Quite simple, Jarryd.

Just a start to get you thinking.

Consumer in Australia bypasses the retail store to buy “x” from o/seas wholesaler for $y. Saves heaps by doing this.

The retail store here cannot compete because of several factors including the GST having to be added to his price, rent, staff etc etc etc.

If more & more people buy overseas online that means less jobs here all round. No jobs no money…..starting to get the picture?

We could start paying our manufacturing staff the same rates of pay to lower the cost of the products we sell…..oh, that would mean a lowering of our living standards…and it goes on & on.

Play by there rules & you have to live by their standards. Simple.

Luke,

I don’t miss the GST issue at all. What is the point of the federal government charging GST on goods under $1000 if it costs them more to administer it than the revenue they receive?

And how much does it cost to collect thte G S T on a $1.00 paper make all my sales uder $1000.00 g s t free

Max,

The point is that Australian retailers CAN compete with their overseas rivals. Just not using their current models. This will be especially true once the dollar drops and we see some normality return to exchange rates.

One also has to accept the fact that we live in a (to use Mark’s words) more borderless economy. The dismantling of many trade restrictions has opened up many international markets for Australian exporters. I don’t see people complaining about this.

Jim,

The collecting of GST by Australian retailers is done automatically by POS systems. It is then reported in lump sums to the tax department. In the case of imports, every single import would have to be administered individually.

And why not ,still got to do the paper work and if i am late a fine

other countries do it why should we not .it is all about the crap in power so they do not lose a vote

Well! I am off to get some stitches in my head….that brick wall is just waaaay to hard.

Not sure how to get such a simple message through:

1. Yes, GST could be payable on all purchases made in Australia – even of overseas websites. However, there has to be a cost benefit on the collection.

2. This GST issue is a red herring. The big issue is poor retailer preparation to compete in a global online shopping mall. No amount of legislation or regulation will fix that.

Do not confuse the two different issues.

Max,

If you have a logical point to make/argue then I’m all ears.

Jim,

Just because other countries do it doesn’t make it a good idea. If the government was going to be financially worse off, then I can’t see how it would benefit anyone.

When you have some life experience Jarryd then maybe I will be all ears to your logic.

No offence to your age but you have only seen good economic conditions in your area.

When the coal in the Hunter is no longer fetching huge prices and workers are no longer on huge wages and unemployement is high and families stop shopping at local supermarkets and newsagencies like the one you work at, instead buying in bulk from Costco or Aldi or even online, then maybe your logic will be different.

You have never worked through record unemployment or maybe yo think the GFC was bad yet it was a tremor compared to what we have been through over the years, but if we do not protect our own retailers then let the workers find jobs overseas or in warehouses at $5 per hour and we will see what the standard of living is and how much they have to spend.

There is no difference in the newsagency paying GST on a paper and an importer paying GST on an import all it takes is software and enforcement with big fines for both the consumer and seller if they avoid it.

I bet there is plenty of businesses out there at the moment that would love to be collecting GST…..pretty hard to do so when their shops are under 3 meters of water or washed away or unreachable…….

So tax us but not overseas sellers why ,short pay the A T O and see what happens o good they let you off .It is all about looking good for gillard

Luke,

Cheap shots are not constructive debate. My age is irrelevant. You are directing the topic away from the issue because, I can only assume, you have no logic to backup your argument.

The good economic conditions I have seen in the Hunter Valley have nothing to do with GST on imports, nor the poor response by retailers to the globalization of markets.

Protecting retailers too much, as has seen directly in this industry in the past (newspaper contracts) makes them uncompetitive. There are plenty of smaller retailers in Australia that successful compete in the online space. The major retailers and many store-front retailers have not successfully taken on this market, not because they cant compete, but because they don’t know how.

I have no idea how the topic of overseas manufacturing wages even came up. It has nothing to do with the topic being discussed.

There is a difference between a newsagency paying GST on a newspaper and an importer paying GST on an import. In one instance the seller (newsagency) collects the GST and reports it to the tax department in lump sums. The administration cost is relatively low because many thousands of transactions are consolidated and reported/paid together. In the case of imports, every single transaction must be reported/paid as well as monitored by customs. Software does not come into the equation for importers.

So my time is worth less

Jim,

The issue is not a political one. Its about dealing with the changes that come with an increasingly globalized economy and finding a suitable balance for tax systems.

And its not business that is being taxed. Business acts as a collection agent for the tax which consumers pay.

One might also argue that sales taxes are too complex and an unnatural fit in the globalized economy. Why have them at all?

Jim,

Jarryd is very close minded. A quick read of his twitter page will tell us that.

I quote: “It’s so much easier when people get that my opinion is the only one that matters”.

You can’t have conversations with people who don’t see the big picture. Only time can prove this point to Jarryd.

It is unfortunate that in this debate people are debating the debater rather than the issue.

Unless I am missing something, Jarryd and I are saying the same thing. We are joined in our view by some eminent commentators.

It would be a mistake to think this the challenge to bricks and mortar retail centres around how GST is handled on purchases made from Australian computers of over seas websites.

Well, sorry, the rest of us obviously aren’t in the same league, to have an opinion that is worthy.

Better that I get back to where I belong.

Max my comment was not a put down. I an trying desperately to focus on the facts and the reality of why choppers are migrating from bricks and mortar to online.

Jarryd no cheap shots,

You do not seem to understand that in 2000 when GST was introduced all retailers in Aust had to bear huge set up costs to get GST compliant, all stock had to be repriced, all systems had to be updated, all staff had to be retrained to understand what was GSt free what was to include 10%, we also had to educate customers within our stores. You brushed this off in your post 31 by saying it is done by the pos which shows your retail in experience not your age.

Mark, you have attacked Gerry Harvey but say that comment of others have made the debate personal? The debate is all about GST nothing else not cheap costs, not globalisation as Jarryd and yourself have commented.

Luke we will have to agree to disagree then as I am confident that history will show online globalisation is the issue and not whether GST is paid on transactions under $1,00.

As for Gerry Harvey, he got what he deserved last week.

And that last comment was not personal, maybe you should stick to the issue as well as the rest of us.

James,

Nice to know someone follows my dead twitter feed. And that quote is actually an inside joke amongst myself and my team.

If you have some different opinions put them out here in the public forum. I’m happy to debate them as I’m sure others are.

Luke,

I actually vaguely remember the introduction of GST. But that was a decade ago. Today the collection of GST is a relatively small administration cost that is for the most part computerised.

The issue is most certainly about globalization. Gerry and his merry band of retailers are, at the very core of their cause, calling for a change in legislation that increases the wall between the Australian domestic economy and the global economy of the Internet.

Thats your problem there Jarryd, you vaguely remember the introduction of GST, if you had of been involved in the huge change in retail at the time and the huge costs involved to small business you would not be so dismissive of it. Once the software and enforcement of imports is set up then the ongoing costs will also be minimal.

If the debate is now about Globalisation and online V brick retailers rather then GST on imports then you have changed it to that debate because you cannot defend NOT adding GST to all imports. It is not about adding a wall against the outside world it is about Australian consumers paying a goods and services tax on items that if they bought here would include such a tax.

Again I am questioning your experience NOT your age.

taking a shot at Jarryd’s age deflects from the core issue.

The problem is that Gerry Harvey jumped on a soapbox and bleated about the GST and how this is causing the loss of billions of dollars in sales and many retail jobs. He is the one who missed the point as I blogged here in another post…

When the wind is in their sales, nothing can get in the way of Gerry Harvey and his rich retailer mates. The moment there is a spoiler, they complain and call on the government to help.

Their current shrill campaign calling for the government to act is ill conceived and miscommunicated.

Yes, GST should apply to all items purchased in Australia regardless of whether they are supplied from an offshore warehouse or not.

Where the Gerry Harvey led campaign falls down is that Australians have no appetite for a rich head of a retail group which delivers poor customer service telling the Australian Government that they should be protected.

It is no wonder that there has been a shopper backlash against the campaign. The common thread of shopper complaints is that customer service sucks in Harvey Norman and other major retail outlets.

This is where small business excels. Small business retailers are more likely to offer friendlier and more knowledgeable customer service. Small business retailers generally live locally and hire local employees. They are better connected to the community.

A small business led campaign educating shoppers about the growing cost to their business of the free GST kick to overseas retailers would have a better chance of gaining grass-roots support and thereby engaging government in finding a solution.

The more Gerry Harvey and his rich mates are on TV complaining the more my small business retail friends can remind their customers of the difference between rich, big and bloated retailers and customer centric small business retailers.

Please read the last line of my last comment.

The problem with this Govt is that will not act in the best interest of Aust, they will only act in there own interest as they have a small grip on power and will prostitute itself out to any group that will allow them to gain votes.

Unfortunately Mark, big business money talks. It is why Coles and Woolies et al have been able to own everything and push more and more small businesses out of the market. The more Gerry Harvey and his rich influential mates complain to Govt, the more likely they will get their way.

There are two points being argued herewith most agreeing on the two points but crossing them over which keeps the argument simmering.

1. Almost every one has agreed that GST should be charged on all retail transactions. This appears a no brainer to me as our tax system is based on GST and should not be undermined. This is a government issue more that a retailer issue and effects the revenue of the government which ultimately effect us all.

2. The bleating of the major retailers is a bit pathetic as they have no qualms about hurting the smaller retailers purely through their size and political clout and deserve to lose business to us due to their lack of customer focus and service. We can compete and beat the majors on service and should be focused on this task. Our advantages over online buying are numerous and we must learn to take advantage of them.

– You can’t pick up and check the quality of a product on a computer monitor.

– You can’t deal personally with some one who knows the product and discuss your needs with a computer monitor.

– You can’t say “I’ll have that one now” and be using your widget 5 minutes later over the net.

– It is harder to return faulty products over the net and again the face to face here is important.

These are our advantages and as small businesses we must be at our best to leverage these advantages. The GST argument is how ever relevant on products with extremely low margins and where price is the prime driver for the consumer. It is up to us to make our service more important in the equation than purely price and we could pick up more business from the majors than we lose to the net, at least in the short term. Longer term ????????????????

Luke,

I’ve been in the retail industry for 9 years. But that is beside the point.

The ongoing cost of monitoring and administering imports under $1000 would be huge. There is no consolidated lump sum reporting as is the case with Australian businesses. That means individual paperwork and processing for every import, no matter how small. The amount of people required to undertake this would be huge.

I’m not dismissive of the huge cost that the implementation of GST was on small business because I wasn’t involved, I’m dismissive of it because it has absolutely no relevance to the topic at hand.

Brendan,

In regards to your first point, what is collecting GST on imports under $1000 actually negatively affects the governments revenue because of a high administration cost?

Jarryd, I don’t know whether or not this would be cost effective….obviously you have the data at hand hand and know it isn’t???

Jarryd are you in A L P

Brendan,

No I don’t, thats why I only posed the question as a possible scenario. The treasurer and a number of experts have raised it as a possibility.

Jim,

No. I’m not a member of any political party and didn’t even vote for the ALP last election.

Jarryd, just as I have posed the possibilty of collecting gst on these sales as a desirable scenario and yet you howl the idea down as though you are an expert with knowledge that the rest of us do not posess

Brendan,

I’m not howling down the idea of collecting GST on imports under $1000. If it can provide the government with an additional revenue stream that they are currently missing out on then I would certainly support it.

I am simply asking if you would still support the collection of GST on imports under $1000 if it was found that the government would be financially worse off because of it.

I used to have arguements with my brother like this where we said the same thing different ways and argued even though we actually agreed.

It is all about votes for the A L P .There must be the same rule for all , it must be fair and be seen to fair

Hopefully some of the energy demonstrated here will make its way to the productivity commission inquiry into all this.