I do not see any upside in over the counter bill payment for newsagents.

With online widely available and becoming more secure, the barriers to online payment are reducing.

Suppliers, too, are embracing online, offering rewards for paperless (online) transactions.

Banks and suppliers, too, are making scheduled payments easier and this helps with family budgeting.

A study from 2011 by the RBA provides the most recent insight into this area of online bill payment.

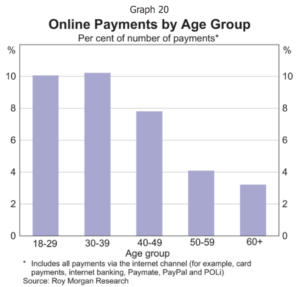

While these are important, the other factor for counter (OTC) bill payment is the demographic. OTC bill payment customers are likely to be older. This means a higher time cost to process, more complaints and less likelihood of add-on purchase. These three points are based on anecdotal evidence from recent years.

While these are important, the other factor for counter (OTC) bill payment is the demographic. OTC bill payment customers are likely to be older. This means a higher time cost to process, more complaints and less likelihood of add-on purchase. These three points are based on anecdotal evidence from recent years.

If we go back to the time of Bill Express, the OTC bill payment service on which newsagents lost tens of millions of dollars, shopping basket data from that time revealed 80% of bill payment transactions were bill payment and nothing else. So, there is an efficiency question for retailers – efficiency not only at the counter but in terms of space used in-store to pro one the service.

Another consideration is the growth opportunity. Will OTC bill payment grow? Unlikely. There are many other upside opportunities available to newsagents.

For me, though, the biggest factor in the consideration of OTC bill payment is that it is agency business, business for which the retailer receives a small fee that is unlikely to reflect the true cost of providing the service and that in providing the service higher margin opportunities are interrupted or stopped. It is not good business in my view, it does not fit with my business model.

Once I define myself as a retailer, decisions about agency lines is clearer.

Mark I see your point however I prefer a customer in my shop as many times as possible every time he or she walks it equals to an opportunity. This might be an impulse purchase or an effective display will enhance them to buy which normally they would not if they do not come in. Let me illustrate something that may convince you of my theory. Yesterday the Sunday Telegraph was almost three hours late unfortunately I did not have sufficient time to complete the delivery run . Customers came in the shop to collect their paper as they know there was a problem as I am always ultra reliable with my deliveries. Two out of five customers purchased something while they were in the shop, one spent over $100 on lottery products two purchased gift cards others stationery and magazines.Normally these customers do not come in my store and shop elsewhere they have a subscription for their paper and pay direct to the publisher where as the ones I send out account who deal direct with me do frequent my shop more often and spend more with me.

The point about the older demographic being primary users of OTC payment can be a key factor for offering the service. If you have toys or children’s books for sale there is a good chance for an impulse purchase to grandparents. At worst getting them into the shop is free advertising of what you have on offer for purchasing later. Also the older generation tend to have a larger circle of influence and good word of mouth is the best form of advertising.

Getting people into the store is a hard cost/benefit to calculate. Simply looking at things like cost of employee time to revenue for an agency transaction doesn’t take into account the intangible value of getting people in store to see what you have on offer and the opportunity to provide good service and convenience.

If the majority of the business is agency revenue then yes, it is a dwindling revenue source with fixed costs. However if you are leveraging it to gain other revenue from more profitable areas of the business it can be worthwhile.

I am not aware of any retailers who that I can find to support any upside from OTC bill payment.

Given that BPay offer newsagents 50 cents per bill, (less than it would cost a newsagent to process most bill payment transactions electronically) I’m interested to hear how those accepting bill payments handle the resultant issues. Do you add a surcharge, wear the cost, accept cash payments only, etc? How does this go down with your customers?

So at 50cents a bill you’re getting less than half what a Post Office makes from taking the same payment and it’s marginal there for them !