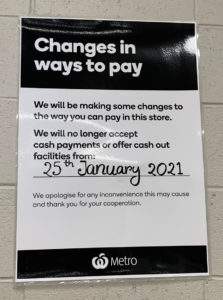

Another Woolworths Metro store in Sydney is going cashless. The announcement of the move is kicking up a storm on social media with over 2,000 tweets yesterday in a few hours.

Another Woolworths Metro store in Sydney is going cashless. The announcement of the move is kicking up a storm on social media with over 2,000 tweets yesterday in a few hours.

It will be interesting to see how this plays out for the company. In several US cities now regulations have been passed requiring cashless retailers to have a facility for taking cash from people who request that.

I don’t see any reason for government to step in and force businesses to take cash.

If a business chooses not to take cash, that’s their decision.

Its 2021, anyone should be able to get a bank account and card these days…

I agree Jonathan however the Government of the day Labor or Liberal can order that cash is legal currency issed by the Reserve Bank of Australia. They may not do this however they can. Bank accounts attact fees and other problkems. However cash is a pain in the Butt.

There is one thing about cash compared to other forms of payments. It does not leave the traceable tracks that they do.

The critical thing with cash is that it does not rely on third parties or electronic networks in order to be able to use it. Bank accounts and cards are great whilst you can access them, but what happens in a time of crisis or if electronic networks are compromised?

You only have to look at the recent issues Tyro has had to know these systems are not infallible. Cash has, and always will have, an important place in the trading landscape.

Cash is the Legal Tender produced by the Government through the Reserve Bank.

This is World wide -In the technical argument there is nothing more solid than cash.

The rest including credit cards, Bit Coin, Guaranrees, Eftpos Direct Debits are not Government backed.

It is a guaranteed by itself the actual holder owns it, Government guarantede. The rest has complications and is totally relied upon the person.

We tend to think of cash as inconvenient, sometimes as a tax dodge (which is why GST was introduced at least the Govt gets 10% on purchases) plus a nusiance in counting and then the time to prepare Banking and the actual transaction of Banking.

Be careful of what we wish for The banks are behind a Cashless society they want all things on line and to close Branches.

Supporting a cashless society promotes their cause increase retailers risk and creates a great deal more fraud.

Becareful of what you wish for what you get may be so different and then irreversible.

So as well as leaving less tracks cash also provides more freedom than other forms of payment and the tyranny of banks and government.

This from the RBA, from November 2018, adds to the conversation: https://www.rba.gov.au/speeches/2018/sp-gov-2018-11-26.html

Seems to be moving pretty fast since that 2018 speech Mark. Covid has played a big role. Despite the massive increase in the volume of cashless payments over the last 12 months I’m still not seeing the required decrease in transaction costs .There is also plenty of evidence of the need for emergency payment alternatives over the same period. People who do not carry this emergency reserve still amaze me.

Reserve Bank Governor”s speech in late 2018 in section 4. and aummary 5. does explain that it’s possible with the ‘Big Tech” end being able to do it. However it’s unlikely that we will ever see a fully cashless society in our life time

The article illustrates this although it is a bit like on line shopping incredible growth with major retails Premier, JB Hi Fi Harvey Norman having record profits -record overall sales

We’ll see the fall back position for both cash and on line as the COVID situation fades. Meanwhile it’s certainly and issue and a disruption especially doing both.

Steve I think a couple of things have happened.

In 2021 we have more payment options than in 2018. Online, for example, on websites in run in my shops, we have 5 or more payment types whereas in 2018 we had 2. I hope that competition leads to lower costs, but it may be feint hope.

Here in inner Melbourne, the number of businesses that have remained cashless is high. From where I sit right now in my Hawthorn office, at least 7 cafes have remained cashless, 2 butchers and 2 gift shops.

I am not writing this to advocate cashless. rather, to note that it’s come a long way from 2020.

“Essential” businesess should always be able to take cash especially supermarkets. Being able to buy necessities because of multiple reasons to do with not being able to use cashless isn’t right.

You wouldn’t want to go cashless if you relied on Tyro .

What a disaster, it’s been over 2 weeks since our Tyro machine locked , the only communication from Tyro has been an apologetic email , but nothing to indicate where our terminal is, no tracking information no time line as to when it will be returned .

That has not been my experience Mark. Their agent collected the terminal late on Jan 8 and I had it back first thing Jan 13. I got a tracking email that let me see what was happening. I received 6 emails from them. I emailed them as per the information in their email to me.

Hi Peter we are rural about 80km from Adelaide we have other retailers here using Tyro and they are all experiencing the same issues as we have , no feedback , no tracking , still no terminal we have since installed a new eftpos terminal from our bank.

We now have lower fees and a more modern terminal . Never again will we use Tyro

There was on offer from Newspower roughly 3 or more more months ago which effectively nearly halved my Tyro Fees. I was skeptical till I saw the results.

However with customer led switch to EFTPOS at Fees up to $500 a month it is now a significant cost. Not withstanding earlier comments of mine customers are demanding it and if I were to refuse it it would cost me custom.

newsXpress set up least cost routing with Tyro 18 months ago with some stores saving around 35% in fees a month. That was the second cut in fees with the first a few months earlier. The group also has a business management strategy for mitigating the higher cost of EFTPOS due to Covid.

Maybe check your junk email Mark R as they were true to their word and communicated well. I applaud them for their handling of what must have been an awful situation

Peter have checked all email folders the only correspondence we have recieved is we are sorry emails very poor form