Merry Christmas

Have a wonderful Christmas. Make memories that will bring joy in years to come. Take a moment to think about how awesome you’d like 2026 to be.

Thank you for checking this place out over the last year. I appreciate it.

Have a wonderful Christmas. Make memories that will bring joy in years to come. Take a moment to think about how awesome you’d like 2026 to be.

Thank you for checking this place out over the last year. I appreciate it.

A big supplier walks into a newsagency and dumps cash, thousands, and in some cases, hundreds of thousands of dollars on the table. The goal? To buy their business.

Their pitch is about the money, and not the box. Now here, the box I refer to is product.

To a retailer facing rising costs and tight margins, that bag of cash looks like a lifeline. But in the long run, it’s often a noose. I have seen this so many times in our newsagency channel.

When a retailer’s focus is on the immediate cash injection, business logic often goes out the window. I have seen this happen.

Taking the cash is almost always the wrong decision. It makes you a weak servant, often supplied with less than ideal boxes (products).

It’s not free cash though. There are strings, strings that can shackle the business and leave it work off, for years. I have seen this happen.

There is often no consideration as to whether the products they are now “locked-in” to taking are actually the best fit for their business. There’s no deep dive into the lost opportunity cost, the money they could have made over the next five years if they had the freedom to stock better-performing lines. The decision becomes about the “free” cash today, ignoring the debt it creates for tomorrow.

When a supplier uses cash to buy your commitment, they expose a lack of faith in their products and their sales people to adequately represent their business:

It’s lazy marketing. It prioritises the supplier’s desire for guaranteed volume over the retailer’s need for agility.

Independent retailers, especially newsagents, survive by being different. We thrive by pivoting quickly to trends and offering the unique, local, or niche products that big-box stores won’t touch.

When a supplier locks a small business into a rigid, long-term supply contract, they strip that agility. Without even realising it until it’s too late, the local indie retailer has been turned into a static franchise outlet for a single brand.

This money strategy hurst our channel. It kills innovation.

If you believe in your product, let it fight for its place on the shelf.

Real loyalty from a newsagent isn’t bought with a lump sum; it’s earned through turnover, margin, and service. Don’t handcuff retailers with a contract they only signed because you dangled a bag of cash in a moment of weakness.

It’s time to stop buying market share. Start earning it.

As for the retailers? Next time you’re offered “the money or the box,” remember: your future is in the box. Choose the products that work, not the cash that binds.

I’ve been deliberately vague in this post because I don’t want a legal threat from suppliers offering bags of cash today to win business from newsagents. I mean, I would have thought they would have earned their lesson from hundreds of thousands of losses when businesses they gave cash to failed.

Suppliers paying for business newsagents is bad for your channel. Maybe the suppliers need to lose more money before they stop the practice.

…

Mark Fletcher founded newsagency software company Tower Systems and is the CEO of newsXpress, a marketing group serving innovative newsagents keen to evolve their businesses for a bright future. You can reach him on mark@newsxpress.com.au or 0418 321 338.

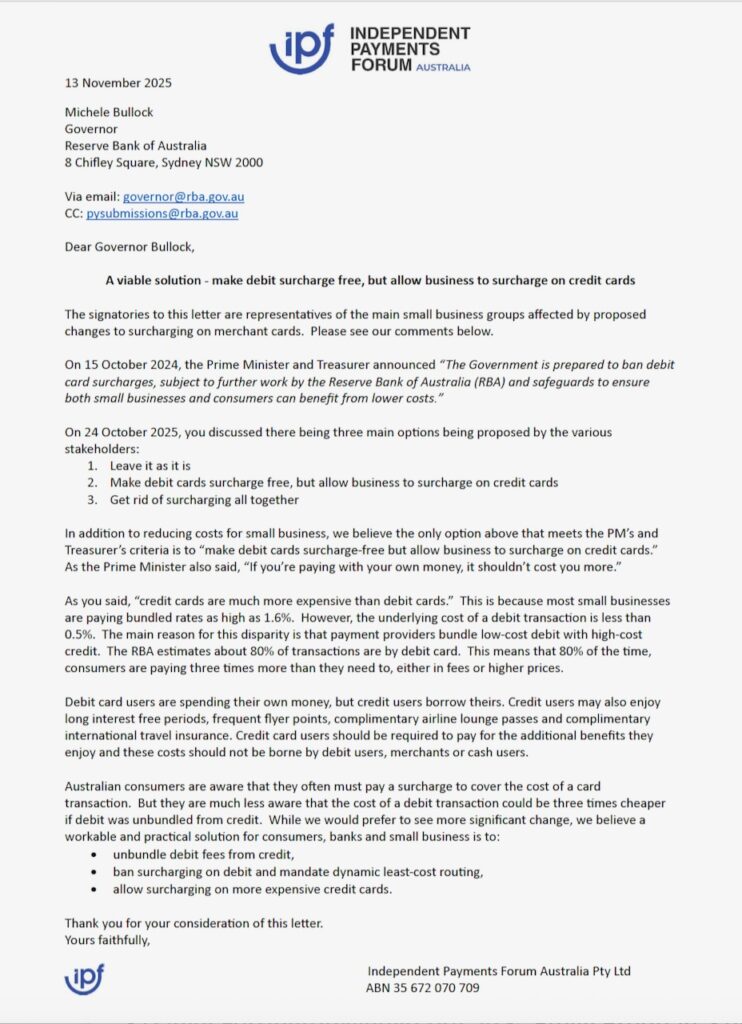

The Independent Payments Forum, a lobby organisation representing many small business groups including ALNA members and newsXpress members from our channel, continues to lobby for more equitable payments arrangements.

The core issue being dealt with here is that payment providers “bundle” low-cost debit card fees with high-cost credit card fees

This means that for 8 out of 10 sales, we (and our customers) are paying a fee that is more than three times higher than it should be.

The current situation places an unfair burden on small businesses for the profit of the banks, because those in power for decades have not cared enough to support fairness for small businesses. We either matter to them, or not.

Here is their latest letter to the IPF, which had my signature presenting newsXpress members.

The letter to the RBA supports the government’s idea of making debit surcharge-free, but only if it’s done correctly. Banning all surcharges (Option 3) would be disastrous, forcing us to absorb all credit card costs or raise our prices for everyone

Small business retailers, like newsagents, are dealt with poorly by banks, the RBA, payments companies and politicians in this area. It is only continued lobbying, like the work of the IPF, that offers any hope of an outcome that’s reasonable for us.

This proposal by the IPF is a win-win if adopted by those in control.

This proposal from the IPF is the only option that fixes the root cause of the problem. It brings fairness and transparency to a system that has been costing us—and our customers—too much for far too long.

What the IPF is proposing here is our best chance to fix a system that has been unfair to small businesses and our customers for too long. By standing with and supporting the IPS on this, we are pushing for a common-sense change. This solution allows us to finally offer our debit-using customers the surcharge-free experience they deserve, while ensuring our businesses aren’t left to pay for expensive credit card reward programs. It’s the only option that brings true fairness and transparency to our counters.

It does surprise me that other groups that claim to represent newsagents are not supporting the IPF.

…

Mark Fletcher founded newsagency software company Tower Systems and is the CEO of newsXpress, a marketing group serving innovative newsagents keen to evolve their businesses for a bright future. You can reach him on mark@newsxpress.com.au or 0418 321 338.

Way to go Amazon celebrating 11/11, Remembrance Day, a day we remember all who have fallen in wars and conflicts. I am surprised you’re not doing something even more enticing to get us shopping at 11am.

I heard about this by way of an email from Amazon to me, as a customer of theirs.

I had a newsagent on the phone yesterday asking for help to get out of an agreement they signed a couple of months ago with a marketing group I won’t name. The newsagent says they were told they could leave if they were not happy. The agreement they signed locks them in. They’ve already been told by the head of the group that there would be legal action if they try and leave.

The agreement is clear. They are locked in for a few years with a group they are unhappy with, a group they say is not helping their business.

Before you sign an agreement with a marketing group read the contract. read it. be sure you understand it. be sure you know what you would be agreeing to if you sign it and are happy to stand by the terms of the agreement

Do not sign the agreement based on what someone says. Read it. Sign the agreement based only on what the agreement says.

This is a problem in our channel, especially for new newsagents buying their first business. They are easily dazzled by a friendly sales pitch. Beware the friendly sales pitch. You’re not signing to be their friend, you’re signing for the business they represent to help you thrive, or at least that’s what you’re hoping for.

If you are uncomfortable with the agreement, don’t sign it.

Make sure you know the minimum period you’re required to be in the group. This is your locked-in period. Read it in the contract. Are you sure you want to commit for that period of time?

If you’re not sure, don’t sign. You’re in control at this point.

Now, if the business you are buying is branded to a group and they are pressuring to sign to keep that branding and they say there is a cost to you if you don’t join the group because you have too de-brand that’s nonsense. The current owner needs to sort out the branding before they sell. Don’t be duped into thinking you must stick with the current brand if you are not sure.

Do what you think is right for you.

Now, on the brands. Take a moment to think about them. What do they stand for? How are they known by shoppers? What is their value? I don’t want spin answers from the groups. rather, I want answers from shoppers.

With any of the groups in our newsagency channel you can visit 10 different shops in the group and have 10 very different experiences. Consistency is not there.

The brand that matters is your brand, what you call, your business. It’s what you do locally that matters.

Before you sign an agreement with any newsagency marketing group, read it, understand it and only sign if you fully understand it and are completely happy with all of the terms.

The person I spoke with yesterday was in tears. They desperately want to leave the group but are scared of legal action. An ethical marketing group would help them leave to find a home in which they are more comfortable.

The West Australian cover price increased 50 cents today, to $3.00. It’s a 20% increase. (corrected)

From each sale, a retail newsagent makes 30 cents.

If a customer pays by a card and the shop does not surcharge, what the shop makes gets cut to 29.58 cents but more on that another time.

The shop has to fund theft from the 30 cents. Oh, and the 30 cents has to cover the cost of labour, the retail space, and overheads.

Let’s say a typical newsagency sells 30 of these newspapers a day. Heck, let’s make it 50 a day for this scenario.

That’s $15.00 the newsagent makes, not allowing for payment processing costs.

The time taken to unpack the papers, count them, make off the invoice and put out the stock and take off and count the unsold stock is, say, 10 minutes. That costs the business at least $4.20. If we were being thorough in analysing labour costs we would add a cost for each sale, but let’s not worry about that today.

The newspapers take up a set amount of space. Allowing for average lease costs, average shop space and a typical newspaper placement, it’s reasonable to say the retail space costs between $1.00 and $1.50 a day. For this post, we’ll agree on a $1.00 a day cost.

On average, the cost of theft of newspapers costs newsagents the equivalent of 2% of total newspaper sales in a year. In a shop like our example here it’s like the cost of a paper a day. I’m happy to cut that in half and say the cost of theft averages out to $1.50 a day.

So, from the $15.00 made from papers each day we deduct $4.20 being the labour cost, $1.00 being the cost of the retail space and $1.50 being the cost of theft. This leave $8.30. not allowing for the overheads of running the business and not allowing for opportunity cost – what we could do in that space if we did not have newspapers.

Until around eight years ago, newspaper traffic was valuable for a newsagency with the habit based shopper purchasing enough other products to make being a newspaper destination worth it. With newspapers now everywhere, the habit based shopper is rare, making the value of the newspaper shopper less.

Back to $8.30 the newsagent in my hypothetical makes from selling fifty newspapers. That’s 16.6 cents per sale.

The moment you slice the 50 newspapers a day into half, the numbers are awful as the labour cost and retail space costs are the same and theft will not be far off being the same. At 25 papers a day, the newsagent is left with 80 cents a day to cover the labour cost of selling 25 newspapers.

If you’re not a newsagent and reading this maybe now you can see why more newsagents are choosing to not sell newspapers.

Given the cost of labour retail space and theft, a $3.00 sale of The West Australian should, in my opinion, net a newsagent at least $1.00. That would be closer to being fair.

The current model of compensating retail newsagents for the sale of newspapers does not provide for a living wage. It is unfair. Nine Media, News Corp and other newspaper publishers need to pay a fair commercial rate for the services provided. That’s what a socially responsible business would do.

I’d love to see how the supermarkets are compensated, like completely compensated. I can’t imagine them accepting what newsagents get.

Liberal senator Dave Sharma penned an op. ed. for The Australian Financial Review claiming the RBA position on card surcharges is a considered way forward toward a more modern and competitive system.

The opening line of his piece sets up up for his ignorant take.

Paying a fee in order to spend your own money is a strange state of affairs.

Does he not understand business, that businesses have costs and the costs are reflected in the costs of products. With the current approach to surcharging, retailers are advising consumers the cost of this part of their business. I would not, however, that some lazy retailers go for a high cost payments option in the knowledge that they can pass that on. I think this is poor form by these retailers when there are payments costs well under 1% readily available. But, I digress.

The currently published position by the RBA if implemented fails small business retailers.

Sharma goes on to write:

The abolition of card surcharges would bring card payments in line with cash and be of immediate benefit to consumers and households, saving them a collective $1.2 billion. Mandating the reduction of wholesale fees linked to card use will benefit merchants, and particularly small businesses.

It seems like Sharma has not read the RBA consultation paper.

My concern is that small business retailers like newsagents are ignoring what’s is being discussed here and that they will only arc-up when it is too late.

Right now is when we need to be approaching our local federal politicians so they understand the risk to small business retail of the flawed RBA position on surcharges. The RBA claim to eliminate the cost of surcharges on consumers is nonsense unless small business retailers are given payments costs that match the sweetheart deals given to big business.

Dave Sharma needs to do better research before writing next in the big business mouthpiece, the AFR.

Meanwhile New Zealand’s Commerce Commission has retained a zero debit interchange option, continued card surcharging and reduced other interchange fees for businesses accepting Visa and Mastercard payments. Hmm, what is it with politicians and their lack of apparent understanding of business.

The front page pot The National in Scotland tomorrow:

It is good to see more ATM providers removing ATMs from tobacco shops.

One of Australia’s largest private ATM suppliers, Macquarie Group-backed Next Payments, is removing more than 40 of its machines from suspected illegal tobacco stores.

Next Payments chief executive Tim Wildash announced the move after an ABC investigation found ATM companies were cutting deals with tobacco criminals and installing their machines in high turnover illegal cigarette shops.

Mr Wildash said he had not been aware of the extent of the issue until the ABC’s reporting, and he was insisting the company remove ATMs from the outlets.

A large number of illegal tobacco retailers use card payments terminals provided by banks and fintechs to sell illegal products according to multiple news reports. So, this latest move. by Macquarie, is a good step against this support for illegal tobacco retailers.

The latest move is on the back of this story from the ABC.

Tobacco shop ATMs can do triple the business

The ABC has obtained court documents from a legal action sparked by the turf war between the ATM suppliers over Al Deleymi’s business.

The documents reveal the normally secret returns generated by ATMs in tobacco shops, including how in some cases such machines do triple the business of a normal ATM.

…

Transaction rate dwarfs typical ATMs

To prove how much revenue was lost, atm2go offered up details of how fee deals for private ATMs are structured.

Atm2go stated it charged customers $2.50 for each cash withdrawal and that Al Deleymi would earn a cut of each transaction fee of up to $1.30.

One machine at a Caboolture tobacco store recorded 165 transactions daily throughout May 2022, while a second racked up 155. Together, they reaped daily average fees of $408.79.

This transaction rate dwarfs that of typical Australian ATMs, which record an average of only 38 cash withdrawals a day, according to Reserve Bank of Australia figures.

This high transaction rate came despite the presence of other ATMs nearby.

With tobacco products present in around 20% of retail newsagencies, this story is one of interest for our channel.

It is good to see action on illegal tobacco.

The Reserve Bank of Australia has released its Review of Merchant Card Payment Costs and Surcharging Consultation Paper.

The RBA consultation paper proposed no changes that support or protect small businesses from the absolute dominance of the payments space by the big four banks in Australia and multi national corporations that put offshore profits ahead of Aussie consumers and small business owners.

The RBA could have taken a clearer position. What the Governor wrote in a OpEd in News Corp papers today reflects breathtaking ignorance on surcharges, the costs businesses, especially small businesses, face and how banks and others behave in relation to small business retailers.

Least cost routing (LCR). The RBA is considering whether a formal mandate for LCR is necessary, particularly for in-person and online transactions. For small businesses, wider adoption of LCR could lead to significant savings on merchant fees. Evidence indicates that merchants with LCR enabled have nearly 20% lower debit card transaction costs.

Interchange fees. A huge gap exists between the interchange fees paid by large and small businesses yet each transaction for each business has the same costs for the providers. The RBA says it is exploring measures to address this, which could include setting a floor on interchange rates or introducing lower caps on these fees for transactions at small businesses. While I’m no expert, I don’t see what has to be explored: regulate so everyone is on the same playing field.

Ban on surcharging. Without fixing the above to be fair for small businesses, a ban on surcharging will not save $1.2B for Aussies as the cost will still be there. Without corresponding reductions in underlying costs, could force small businesses to either absorb losses or increase prices, potentially making them less competitive.

A ban on surcharging without fairness on interchange fees and mandated least cost routing would be unfair to small business retailers.

The RBA may say they need to do their thing in isolation. They con’t. They and the government need to work hand in hand to fix the current broken and fundamentally unfair system.

If small business retailers really are as important to Australia as politicians from all parties tell us we are, right now is the time for them to step up for as things look, small business retailers are about to be fed a turd sandwich.

If you are a small business retailer here is what you can do today in addition to lobbying your local federal member and senators.

If small business retailers really are as important to Australia as politicians from all parties tell us we are, right now is the time for them to step up for as things look, small business retailers are about to be fed a turd sandwich.

Ron Thorpe worked for Hallmark Australia for forty years. For much of that time he was the face and personality of Hallmark Australia during years when the company understood the importance of this.

Ron understood newsagents, he understood small business, he understood local. He helped plenty. He also helped the Hallmark, back then, understand the value of our channel to the company.

Ron was a terrific networker, and an engaging storyteller. We was an epic travel planner, hosting plenty of retail study tours to the US through Hallmark. These are trips on which long lasting friendships were made and valuable business insights were gained.

His departure from Hallmark left a big hole that the company has struggled to fill. I am grateful for his time working with newsXpress, contributing in so many ways to the development of the group. He serves our member newsagents well and was a wonderful host of conferences.

While in recent years Ron has not been as involved with newsagents as he once was, his advice and support was not lost to those grateful to have been influenced by him.

Ron passed away last week.

This photo is from October 2009, when Ron was MC of the newsXpress national conference at the Hyatt in Melbourne. He was fun, and inspiring.

Our Aussie newsagency channel could use more Ron Thorpes: people in big business suppliers who understand and support local small business retailers and who bring two sides together.

Go well Ron.

Following someone can be fun, and feel fulfilling, like you belong to something. The thing is though, feeling fulfilled is different to actually making a difference.

While Cash Out Day may make you feel like you are doing something on the day, unless you actively engage with using cash all year round the day is nothing more than a childish feel good stunt.

If you want cash to have a bright future, use it. That’s all that is needed. Use cash.

Stunts like Cash Out Day are good for social media and people chasing clicks, but not much else. I’ve not seen any evidence of Cash Out Day making any real difference.

Go to a shop, pay with cash. That’s the best action you can take. Withdrawing from an ATM on a specific day is 100% a stunt.

Imagine if everyone who withdraws money from the ATM on Cash Out Day spends a bit of cash every couple of days for a year in local shops. Now that would drive a big difference and have a big impact, far more so than withdrawing cash from bank ATMs.

I hope we more beyond the superficiality of a designated day and embrace the practical power of consistent action.

The future of cash doesn’t hinge on a single, fleeting event designed for social media buzz. Instead, it lies in the hands of individuals making conscious choices to use physical currency in their everyday transactions, supporting local economies and demonstrating a genuine, ongoing commitment. This sustained effort, multiplied across communities, holds the true potential for impact, far outweighing the temporary satisfaction of a symbolic gesture.

If cash matters to you, as a retailer you can do your bit by supporting cash at every opportunity. This can include educating people about the use of cash all year round and not playing follow the leader with a Cash Out Day pitch.

Ultimately, the true power to sustain cash lies in everyday use. By actively encouraging and facilitating cash transactions year-round, we can play a vital role in fostering this habit, making a tangible difference that extends far beyond the ephemeral buzz of a single day.

If you are aware of a newsagent selling illegal tobacco, report them.

Yes, it’s as black and white as that.

Any newsagent selling illegal tobacco damages the reputation of the channel, even for the majority of newsagents in our channel who do not sell tobacco.

Whether we like it or not, our shingle binds us. This is why I think we need to call out bad behaviour, like selling illegal tobacco.

With more newsagents getting back into tobacco, unfortunately, this is an issue we need to confront. The best way in my opinion is to report those we know to be selling illegal tobacco. The more they are fined the better.

You can report it to the ATO: https://www.ato.gov.au/about-ato/tax-avoidance/the-fight-against-tax-crime/our-focus/illicit-tobacco The Australian Criminal Intelligence Commission also has a hotline: https://www.acic.gov.au/contact/report-crime

If you know someone involved in importing illegal tobacco, report it here: https://www.abf.gov.au/about-us/what-we-do/borderwatch

I’ve done some searching by state / territory and here are links for reporting illegal tobacco sales:

VIC: https://www.health.vic.gov.au/tobacco-reform/making-a-report-or-complaint-tobacco-reform

NSW: https://www.health.nsw.gov.au/tobacco/Pages/let-us-know-reports-complaints.aspx

QLD: https://www.health.qld.gov.au/public-health/topics/tobacco-laws/penalties/reporting-a-possible-breach-of-smoking-laws

SA: https://www.sa.gov.au/topics/business-and-trade/licensing/tobacco/report-unlicensed-tobacco-supply

TAS: https://www.health.tas.gov.au/health-topics/smoking/selling-smoking-products/contact-us

NT: https://crimestoppersnt.com.au/ or https://pfes.nt.gov.au/reportonline

ACT: This was too hard to find.

I have heard plenty of newsagents complain about illegal tobacco recently. The question I have when I hear it is what have you done about it? Complaining to colleagues and friends does nothing. Making a formal complaint to the authorities is good action.

My advice is that you complain to your state / territory authority as well as to the ATO and to the Australian Criminal Intelligence Commission. Hitting multiple bases makes sense.

Beyond the immediate reputational damage to our channel, the sale of illegal tobacco also undermines public health efforts and fuels organised crime. By failing to report these activities, we inadvertently become complicit in a shadow economy that disregards regulations designed to protect our communities.

Taking action is about safeguarding our businesses and our channel; it’s about upholding ethical standards and contributing to a safer, more responsible retail environment for everyone.

Ultimately, reporting illegal tobacco sales is an act of self-preservation for the legitimate newsagency channel and a responsible contribution to the wider community.

If you are a newsagent selling illegal tobacco I hope you are reported and fined to the full extent of the law.

The apology issued by ACM Media following the publishing of the ad feels inadequate. At the very least, their ad process is broken. At worst, they knew what they were doing and were happy to sell their space.

In my opinion, this ad is wilfully ignorant, offensive and appalling. If I had this newspaper in my shop I’d misplace the entire delivery until returns time. The ad fails the company’s own published values, which include:

Kind – Being considerate, well-intentioned and thoughtful to others

We are considerate and well-intentioned toward colleagues, clients, customers and communities

We seek to create understanding and tolerance in times of discord

We take time to support our team members and recognise a job well done

Tolerance. They failed.

Payday News has published about payments processing in shops selling illegal tobacco:

Illegal tobacco stores are popping up around the country in what is fast becoming multi-billion dollar market for organised crime which appears to be serviced by multiple banks and fintechs for payments.

What are the legal obligations on acquirers, PSPs and card schemes?

An investigation by Payday News last week revealed that a large number of illegal tobacco outlets are using card payments terminals provided by banks and fintechs to sell their illegal products which, according to experts, could have serious legal implications. Some of these shops also have ATMs inside their premises for customers to access cash.

Financial Crime Compliance expert Luke Raven told PAYDAY NEWS illegal tobacco was fraught for payment processors, who often mistakenly think they aren’t captured by Anti-Money Laundering (AML) or Counter-Terrorism Financing (CTF) laws, or misunderstand the extent of their obligations.

“Many payment processing firms think that they aren’t regulated under the AML/CTF regime in Australia, and candidly, they’re wrong,” Raven said.

Retailers of tobacco products operating legally will appreciate this latest coverage.

The recent story on the illegal tobacco by Australian Broadcasting Corporation (ABC)‘s Dan Oakes exposed the extent of illegal tobacco industry and how ubiquitous the trade has become across Australia.

I first wrote here in 2013 that state and federal politicians should be required to undertake a week of genuine paid work experience in a small business in their electorate every year. I have shared this here and elsewhere several times since. I believe it today more than ever.

This next federal election will likely go as many before it when it comes to small business. we will be told how important we are, that they will cut red tape and that they support us. No matter who forms government, it’s likely that little will change when it comes to small business.

While they are happy to visit small businesses, have their photo taken, shake some hands and move on to the next photo op. each visit is stage managed to show them engaged with small business. I say this from personal experience. 16 years ago John Howard and a huge entourage of poress and local politicians visited my shop in Forest Hill for an hour. The coverage was good, and there were good opportunities to talk. The visit was about the GST. None of the small business points raised in the visit were followed up. The shop was a prop.

Here is my proposal to all politicians for this federal election:

I propose a legislated annual “Real Work Week” for all state and federal politicians. This program would require each politician to spend one full week working in a randomly selected small business within their electorate.

The ‘wage’ earned by the politician is paid to a local charity chosen by the business owner.

Besides the practical work experience, the politicians would gain a better understanding of the life and challenges of everyday Australians.

I am confident that after a couple of years we would see this small business work experience program drive a more practical narrative from politicians of all sides- and not just a small business focused narrative but one also more connected with real life.

Local independent small businesses cannot match the resources of well-funded lobbyists. However, we can equip our politicians with the invaluable currency of real-world experience. This “Real Work Week” is about restoring a vital connection between our elected officials and the people they serve. It’s about ensuring that political decisions are rooted in the realities of everyday life, leading to a more equitable and prosperous future for all Australians.

One way to get to better government no matter who is in power is better educated and better experienced politicians. What I propose here is experience. Even this small experience could make a big difference.

For the record: This post has been written and authorised by Mark Fletcher, Richmond, Victoria.

Hey, thanks for stopping by. I hope your Christmas 2025 retail season has been awesome.

Wherever you are, whatever your situation, I hope you experience happiness this Christmas.

It’s an odd trend that’s been emerging in the newsagency channel. More and more, we’re seeing new owners take over established newsagencies and, against all logic, introduce tobacco products. This is puzzling, to say the least.

The profit margins on tobacco are slim. The pool of tobacco-buying customers in Australia is shrinking. And let’s not forget the association with crime, with tobacco outlets becoming targets for attacks. It’s a category that doesn’t sit well with other, more desirable products like high-end gifts, toys, and greeting cards. Plus, the retail fixtures needed for tobacco take up valuable space that could be used for higher-margin items.

I understand that newsagents with a long history of selling tobacco, who’ve built a solid business around it, may choose to continue. But I’m particularly intrigued by those who are new to the industry and are actively adding tobacco to their mix.

Back in the late 1990s, when supermarkets started ramping up their tobacco sales, many newsagents saw the writing on the wall and made the decision to quit. I was one of them. In 1997, we chose to focus on more meaningful products and free up valuable counter space.

Today, I estimate that less than 20% of newsagencies still sell tobacco. However, I’ve noticed a recent uptick in the number of outlets that have added this category. It’s a baffling trend, especially when you consider the negative aspects.

Just the other day, I drove past a newsagency that had recently changed hands. The new owner had removed stationery and gifts and replaced them with tobacco products. This, despite the fact that there are four other tobacco outlets within a short distance. It just doesn’t make sense.

Ultimately, retailers are free to run their businesses as they see fit. But I can’t help but wonder if there’s a strategic reason behind this trend that I’m missing. Perhaps there’s a short-term gain that outweighs the long-term costs.

I believe there are far more positive and profitable product categories that can help newsagents differentiate themselves and attract new customers. Categories that complement lucrative items like greeting cards.

So, why are newsagents adding tobacco to their shops? It’s a question that continues to puzzle me.

Balancing the demands of a small business with personal life is a constant challenge, and often lonely. For many newsagents in 2024, this balancing act has become even more complex due to economic situations, new competition, and shifting supplier dynamics.

Too often, changes are forced on newsagents without care as to the personal impact.

Sadly, some people find the weight of these pressures unbearable. Recently, our channel lost colleague who chose a tragic path. The pain their loss has no doubt caused loved ones and colleagues will be felt for a long time.

We are not alone in life, no matter how challenging the situation. If you or someone you know is feeling overwhelmed, please reach out. We know form health carer professionals that talking about suicide with someone may reduce the risk.

Signs of distress can be subtle, they can be a cry for help. If you notice changes in someone’s behaviour, such as withdrawal, increased irritability, or a sudden decline in performance, talk and offer support. A simple conversation can offer comfort and understanding.

Remember, you are not alone. If you are struggling, please reach out to a mental health professional or a crisis hotline, please talk with someone.

Here are resources that can help:

Let’s all of us in our channel work harder to create a supportive community where everyone feels valued and heard.

I feel for the family and colleagues of the newsagent who recently felt they had no path forward.

Some card companies invest heavily in hiring people good at making prospective customers feel good. Often, they arm them with an expense account for lunches, dinners and coffees. They also give them some cash to splurge to buy your business, cash for fixtures and other things.

None of this matters if you end up with greeting card products that do not perform as well as products from another card company.

Be wary of card reps offering you lunch, dinner or cash to spend in your business.

Any company selling products that uses cash or ‘friendship’ to get you to buy from them should be viewed with skepticism in my opinion as these things take your focus form their products.

Historically, some of the big card companies in our channel built their retail network on ‘friendship’ and other ways of buying business. I know of retailers who subsequently switched card companies and benefited from double-digit sales growth.

Card sales are strong this year. Here is the topline summary data for one of my shops comparing the last month with the same period a year earlier.

![]()

Strong results: 16% up in unit sales and 10% up in revenue.

For everyday captions, the results are even better: up 31% in unit sales and up 27% in revenue. This growth achieved without a card company change – it’s the card company working with us to maximise the opportunity for both our businesses.

This is what matters, it is all that matters: growing revenue, and profitability, to make the business more valuable for all stakeholders. This matters more than a free lunch or some other glad-handing.

I know of a newsagency business that changed hands recently and within days a card company rep was in there greeting the new owners and inviting them out to dinner. The new owners, in their first ever business, felt loved and accepted the invitation. They didn’t think they might be schmoozed into a decision that may not have been in the best interests of their business. Thankfully for them they realised the game being played before they signed an agreement.

Prioritise suppliers who help you make more money in your business, they are more valuable to you than ‘friendship’ or a free meal.

It is challenging seeing a supplier you have supported for years go out with a direct to consumer pitch. I didn’t plan to write about Collins Debden today. An email from them this morning caught my attention.

This is a Collins Debden direct to consumer pitch.

They added me to their marketing database, without my permission. Their email includes a compelling offer:

They end with a offer of social media connection. If only they were this engaged with small business retailers of their products.

I am surprised that they are promoting direct to consumers when they are so far behind with shipping to retailers. Their fulfilment processes are strained and unable to get product to shops on time. Why would an individual feel they could fulfil a single order on time, unless Collins Debden is prioritising their direct to consumer orders. I have no idea whether that is the case tho.

I am tired of suppliers going direct after years and decades of support from retailers like us to drive brand awareness and engagement. They could not go direct as they have if we had not supported as we have.

A supplier going direct demonstrates disrespect for their retail partners. Them doing this while they are party to delays in supply to retailers is appalling. It is a failure of social responsibility on their part.

Thinking about this issue of a supplier going direct more generally …

There are ethical considerations to consider when a long-term supplier decides to go direct-to-consumer.

Ultimately, the ethical approach involves maintaining open communication, acting with integrity, and prioritising the needs of your customers.

We are missing out of revenue from the certain sale of Collins Debden diaries as a result of supply challenges within the Collins Debden business. I have heard from plenty of newsagents in the same situation.

Approaches to the company over the last two months have resulted in what I’d describe as spin. They have not resulted in any stock being delivered, which is frustrating since Amazon Australia appears unaffected by the supply challenges.

That Amazon has stock of what newsagents could be selling right now opens the question of whether the supply delay is part of a recalibration of the go-to-market strategy at Collins Debden. I this is a reasonable question to have when you see a major competitor of stock while yuou have no indication of when your stock will arrive.

While some newsagents have covered diary sales by accessing stock elsewhere, most cannot since the typical diary shopper is brand loyal. That brand loyalty will see them buy wherever they can find the Collins Debden diary they want. This is where Amazon having stock plays out negatively for newsagents. I first heard about Amazon being able to supply from a customer who was frustrated that we did not have stock.

With newsagents aware of cost to their business from the lack of supply by Collins Debden, I anticipate there will be claims against the company for lost sales as well as claims for financial support to move diaries when they do finally arrive. In my opinion, the company would do well to thoughtfully consider how it supports local small business retailers who have been without stock now for close to two months while a major competitor, Amazon, has had stock.

How Collins Debden handles the situation, outside of fixing the supply issues, will speak to the interest the company has in its local small business retailer network. I know plenty of retailers will be watching the situation. I wonder, too, whether there are any matters for regulators here. For example, if there is evidence of preferencing a big retailer (Amazon) over local small business retailers, could that be captured in regulations supporting small businesses.

Like all newsagents who regularly stock Collins Debden diaries, the best solution would have been on time supply and the second best solutions would have been diaries supplied a few weeks late. As of this morning, we are considerably beyond that, with the situation made worse by inadequate communication from the company.

Following my last post (Monday this week), Does your marketing group contract auto-renew? Does it include a lock-out period?, I outline below options you may consider if you find yourself in a marketing group contract you want to leave.

I am not a lawyer. This is not legal advice. In my opinion, a marketing group contract should be so simple straightforward and fair that it does hot need a lawyer to interpret or understand.

If your marketing group contract or agreement is complex and not easy to understand that’s a warning sign right there.

CONTRACT AUTO-RENEWAL.

If you have found your contract has auto-renewed, think about whether it was clear it would and whether the newsagency marketing group contracted you prior to the auto-renewal trigger advising you that auto-renewal was imminent. The ACCC is on record as saying that auto-renewal should be clear and that you should be contacted prior to auto-renewal with enough time for you to say no thanks.

Three newsagents in the last week have told me their newsagency marketing group contracts were auto-renewed without advance warning from the marketing group that it was going to happen. I think any independent party with authority considering this would say renewal action was unfair and that the newsagent could opt to leave the group now.

RESTRAINT OF TRADE – POST CONTRACT LOCK OUT PERIOD.

Some newsagency marketing agreements seek to deny the newsagent the right to join another marketing group for a period of time after the end of the agreement. I have heard marketing groups with such a restraining clause claim that it is to protect their intellectual property shared with the business while they were in the group. The question I have is what intellectual property?

In situations where I have seen newsagents threatened by the group they are leaving, or the lawyers for the group, I have not been able to discover any intellectual property worth protecting.

In a recent report, the ACCC highlighted that restraints which go beyond what is reasonably necessary to protect a franchisor’s legitimate interests are likely to be unfair. For the purposes of this discussion, a franchisor would be the newsagency marketing group.

NEW REGULATIONS.

In November 2023, reforms passed by parliament make unfair contract terms illegal, attracting substantial penalties under the Competition and Consumer Act 2010 and the ASIC Act 2001, with each unfair term forming a separate contravention.

I think it is possible that a newsagent with an agreement that auto-renews and / or with an end of contract lock-out restraint period barring them from joining any other group could challenge the validity of the contract.

While I am not a lawyer and this is not legal advice, if I found myself in this situation I would do several things, all at once:

My point here is that there are options for you, actions you can take that do not require a lawyer, actions that could free you from a contract you no longer want for your business.

I have seen newsagents consider taking steps to get out of a contract only to give up, saying it is too hard. I have also seen newsagents take a couple of steps and be permitted to exit a group as long as they don’t tell anyone.

If you are in a marketing group for your newsagency and want to leave but have been told you cannot or been told that you have a lock-out restraint period, it is possible one or more of the steps listed above could help you out. Doing nothing achieves nothing for your business.

The difference between being in a group doing little for your business and a group doing plenty could be tens of thousands of dollars in net profit in a year.

A good newsagency marketing group is profitable for the newsagency. Belonging just to belong to something is not commercially astute.

I am not going to list marketing group contracts here that I consider to be unfair in part because I have seen some groups with different contracts for different people, which in itself is odd and somewhat concerning. One group has recently become more threatening against newsagents who want to leave, causing considerable distress for the newsagents impacted.

One final point: everything I have written here could relate to some card company contracts I have seen.

Before you sign any agreement, read it, be sure you understand it and ask someone you trust for their opinion.

If you are in a newsagency marketing group, get out the contract you signed and read what it says about termination.

Be sure you understand the term of the contract, whether you have to give notice and if so what length of notice is required and whether there is a period after the end of the contract in which you are not permitted to join another group.

If you are not sure about these things, seek professional advice. Indeed, you should have sought advice prior to signing the contract. It is never too late to seek advice.

TERM.

Newsagency marketing group contracts vary from one year to six years from what I have seen. Personally, I think anything more than one year is too long. Aren’t you better off staying with a group because of the value gain from it rather than because they have legally bound you in a contract? Shouldn’t groups want you to stay because you want to stay.

If they really trust what they offer and the benefits they deliver for you, why lock you in?

Oh, and I do understand the need for an initial term when you first join, to learn from each other, to unlock value for each other.

NOTICE PERIOD.

Some contracts require you to give notice months ahead of the contract renewal period and your failure to do this locks you in for, sometimes, another long period. In my opinion, a notice period of two months is reasonable and anything more is unfair for the small business retailer.

AUTO RENEWAL.

I think auto renewals in a contract are a gotcha, especially if the auto renewal period is long, like a year or more as is the case for some newsagency marketing group contracts I have seen.

I suspect businesses put auto renewal and a long (like a year or more) lock in period in contracts because they know people will not realise they need to give notice to not renew. They are businesses. It’s all about their revenue.

LOCK OUT PERIOD.

Another thing I have seen in newsagency marketing group contracts is a post contract termination lock out period. I have seen them make this case to protect their intellectual property, which I think is a joke. What intellectual property? Okay in the first year maybe, but what after that time? None of the newsagency marketing groups has a system with training, regulation, branding requirements and more like you see in a McDonalds.

If you are happy with your newsagency marketing group contract, this post is not for you.

If you are unhappy, please dig out your contract and look at your options.

If you have been given a newsagency marketing group contract to sign, please read it carefully. Some have worse provisions than the few I have mentioned here, provisions that are very expensive – like demanding you access some products / services only from the supplier they dictate. I saw one newsagent recently pay thousands of dollars more for something than they would have paid had they not been in that group.

Buyer beware is the point here. Do your homework. be sure you fully understand the contract. Be sure you are happy with all terms prior to signing.

Not all newsagency marketing groups are the same.

I know of at least twenty newsagents currently in groups they want to leave but cannot. Some have received legal letters threatening against leaving and others have received less formal yet equally distressing communication. In most cases, that communication was the first time i a year their business received direct communication about their business from the group to which they belong. These newsagents would leave in a heartbeat if they did not feel trapped. None of them want a legal fight, and I suspect some in the marketing groups know this, and use it to their advantage, and the disadvantage of their members.

If you are in a newsagency marketing group, get out the contract you signed and read what it says about termination.