The latest News Corp annual report provides a glimpse into the performance of its Australian Newspapers. When considering the data included and considering previous circulation data we can see declines. For example, as reported in Crikey today, the circulation of the Herald Sun is down 8.5%.

Newsagents see the challenges of print every day in sales numbers.

Here is the part of the News Corp. Annual Report dealing with Australia in its entirety:

News Corp Australia

News Corp Australia is one of the leading news and information providers in Australia by readership, owning over 200 newspapers covering a national, regional and suburban footprint. During the year ended May 31, 2018, its daily, Sunday, weekly and bi-weekly newspapers were read by over

8.4 million Australians on average every week. In addition, its digital mastheads and other websites are among the leading digital news properties in Australia based on monthly unique audience data.

News Corp Australia’s news portfolio includes The Australian and The Weekend Australian (National), The Daily Telegraph and The Sunday Telegraph (Sydney), Herald Sun and Sunday Herald Sun (Melbourne), The Courier Mail and The Sunday Mail (Brisbane) and The Advertiser and Sunday Mail (Adelaide), as well as paid digital platforms for each. In addition, News Corp Australia owns a large number of community newspapers in all major capital cities and leading regional publications in Geelong, across the state of Queensland and in the capital cities of Hobart and Darwin.

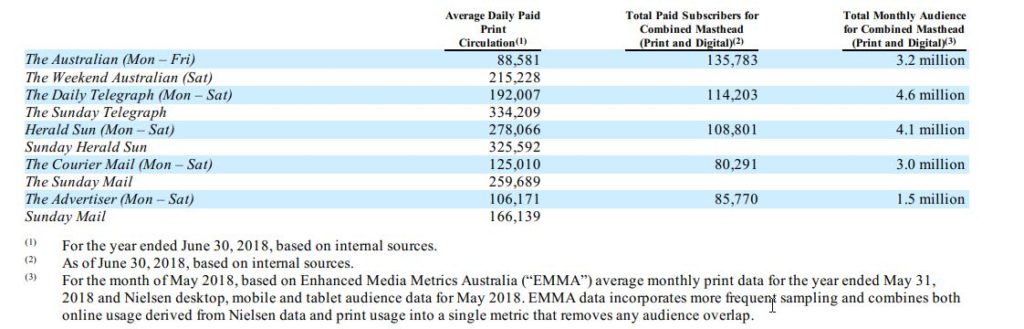

The following table provides information regarding key properties within News Corp Australia’s portfolio:

News Corp Australia’s broad portfolio of digital properties also includes news.com.au, the leading general interest site in Australia that provides breaking news, finance, entertainment, lifestyle, technology and sports news and delivers an average monthly unique audience of approximately 9.1 million based on Nielsen monthly total audience ratings for the year ended June 30, 2018. In addition, News Corp Australia owns other premier properties such as taste.com.au, a leading food and recipe site, and kidspot.com.au, a leading parenting website, as well as various other digital media assets. As of June 30, 2018, News Corp Australia’s other assets included a 13.5% interest in HT&E Limited, which operates a portfolio of Australian radio and outdoor media assets, and a 30.2% interest in Hipages Group Pty Ltd., which operates a leading on-demand home improvement services marketplace.

Further into the report is this interesting par on ad revenue:

The Company’s print and digital advertising revenue is also affected generally by overall national and local economic and business conditions, including consumer spending, housing sales, auto sales, unemployment rates and job creation, advertisers’ budgeting and buying patterns, which tend to be cyclical, as well as federal, state and local election cycles. In addition, certain sectors of the economy account for a significant portion of the Company’s advertising revenues, including retail, technology and finance. Some of these sectors, such as retail, are more susceptible to weakness in economic conditions and have also been under pressure from increased online competition. A decline in the economic prospects of these and other advertisers or the economy in general could alter current or prospective advertisers’ spending priorities or result in consolidation or closures across various industries, which may also reduce the Company’s overall advertising revenue.

Then this on newsprint:

Newsprint Prices May Continue to Be Volatile and Difficult to Predict and Control, and any Increase in Newsprint Costs may Adversely Affect the Company’s Business, Results of Operations and Financial Condition.

Newsprint is one of the largest expenses of the Company’s newspaper publishing units. During the quarter ended June 30, 2018, the Company’s average cost per ton of newsprint was approximately 1% lower than its historical average annual cost per ton over the past five fiscal years on a constant currency basis. The price of newsprint has historically been volatile, and a number of factors may cause prices to increase, including: (1) the closure and consolidation of newsprint mills, which has reduced the number of suppliers over the years; (2) the imposition of tariffs or other restrictions on non-U.S. suppliers of paper; (3) an increase in supplier operating expenses due to rising raw material or energy costs or other factors; (4) failure to maintain the Company’s current consumption levels; and (5) the inability to maintain the Company’s existing relationships with its newsprint suppliers. Any increase in the cost of newsprint could have an adverse effect on the Company’s business, results of operations and financial condition.

And this on print media disruption:

The News and Information Services segment’s advertising volume and rates, circulation and the price of paper are the key variables whose fluctuations can have a material effect on the Company’s operating results and cash flow. The Company has to anticipate the level of advertising volume and rates, circulation and paper prices in managing its businesses to maximize operating profit during expanding and contracting economic cycles. The Company continues to be exposed to risks associated with paper used for printing. Paper is a basic commodity and its price is sensitive to the balance of supply and demand. The Company’s expenses are affected by the cyclical increases and decreases in the price of paper and other factors that may affect paper prices, including tariffs or other restrictions on non-U.S. paper suppliers. The News and Information Services segment’s products compete for readership, audience and advertising with local and national competitors and also compete with other media alternatives in their respective markets. Competition for circulation and subscriptions is based on the content of the products provided, pricing and, from time to time, various promotions. The success of these products also depends upon advertisers’ judgments as to the most effective use of their advertising budgets. Competition for advertising is based upon the reach of the products, advertising rates and advertiser results. Such judgments are based on factors such as cost, availability of alternative media, distribution and quality of consumer demographics.

The Company’s traditional print business faces challenges from alternative media formats and shifting consumer preferences. The Company is also exposed to the impact of long-term structural movements in advertising spending, in particular, the move in advertising from print to digital. These alternative media formats could impact the Company’s overall performance, positively or negatively. In addition, technologies have been and will continue to be developed that allow users to block advertising on websites and mobile devices, which may impact advertising rates or revenues.

As a multi-platform news provider, the Company recognizes the importance of maximizing revenues from a variety of media formats and platforms, both in terms of paid-for content and in new advertising models, and continues to invest in its digital products. Smartphones, tablets and similar devices, their related applications, and other technologies, provide continued opportunities for the Company to make its content available to a new audience of readers, introduce new or different pricing schemes, and develop its products to continue to attract advertisers and/or affect the relationship between content providers and consumers. The Company continues to develop and implement strategies to exploit its content across a variety of media channels and platforms.

Riveting reading. The Sybil Faulty award for stating the bleeding obvious goes to the author.

Fairfax commented yesterday that newsprint sales of their SMH and F.R. up up and away with sales and revenue.

Differs with the story above- We all know the truth.

Fake news is alive and well and truly independent.

AS LONG AS THE PAY SUB AGENTS SHIT MARGINS

I WON’T AND DON’T PROMOTE NEWSPAPERS IN MY 2 NEWSAGENCY/POST OFFICES

SO WHEN I RUN OUT WE NEVER BOTHER TO ORDER MORE.

SO TO HELL WITH THEM

From above,

“Any increase in the cost of newsprint could have an adverse effect on the Company’s business, results of operations and financial condition”

and yet this is the same company who considers 20% plus return rates as acceptable from Subagents to avoid sellouts.

Seems as someone is not talking to Marketing.