The Lottery Corporation has issued an update to the manual that documents rules for retailers selling their products. The rule update bans the use of Buy Now Pay Later (BNPL) payment methods for the purchasing of lottery tickets.

While this is a matter for The Lottery Corporation to determine, operationally in retail there are implications as I covered in correspondence from my newsagency software company, Tower Systems, to senior management at The Lottery Corporation.

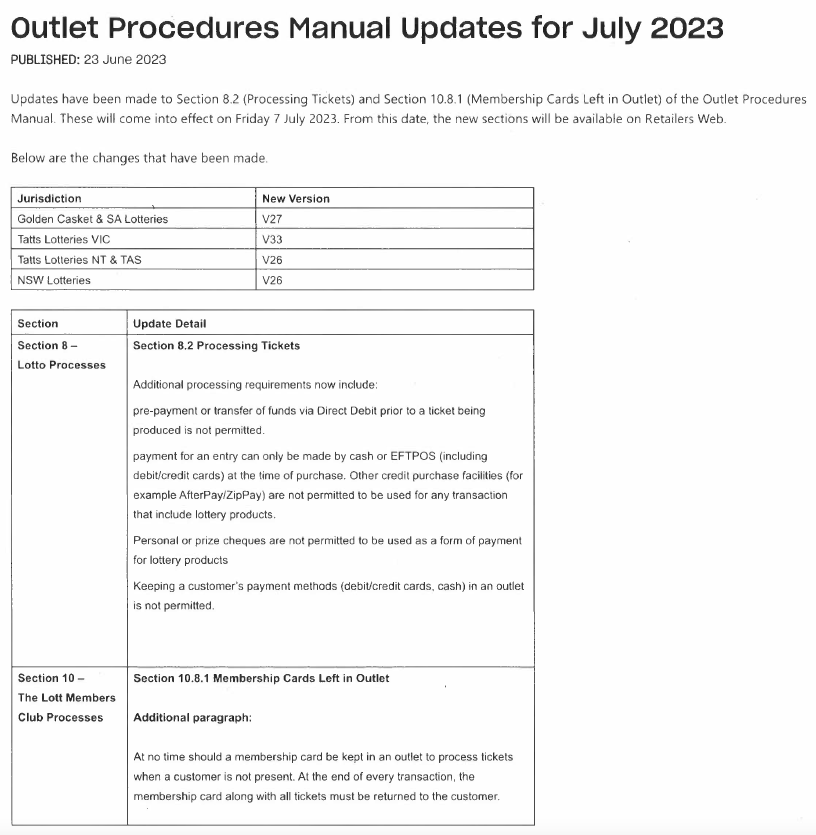

I have just seen the rule changes in relation to buy now pay later.

The problem is that this rule will be very difficult for retailers to enforce given that AfterPay gives customers now a virtual card on their phone and it presents across the counter as a credit card payment.

We have looked at whether we can automatically block the payment from within the POS software. With tech today, it’s the banking organisation that manages types of payments.

We could do something along the lines of what we have done with the Indue, cashless welfare card, work, check what’s in the basket and manage restrictions. But that would cost a chunk of money and it would involve tech changes from many parties.

What POS companies like Tower could do, but it would have a cost, is interrupt a transaction with lottery products in the basket where card payment is presented and require the retail staffer visually check the type of card being used before allowing it to proceed or not.

The challenge here is that your company has issued the new rules without thinking through real world implications.

I can see situations where retailers unwittingly accept AfterPay as a method of payment, costing the retailer valuable margin dollars and putting them in breach of the rules that govern their sale of lottery tickets.

With the way BNPL payments are handled across the counter today, it is only with a visual check of the virtual card being used that the retail associate can have the information required to know what type of card has been used.

In high traffic settings the time disruption for such a check will be challenging to deal with. There are also shoppers who will not want to show their phone to show the method of payment.

An integrated tech solution is better for all concerned. But, doing this properly would be expensive.

The less there is a requirement for human engagement on checking the better for all concerned.

While BNPL providers have their own rules, I think The Lottery Corporation is more likely to enforce the rules than the BNPL providers.

Hopefully, a workable solution can be found.

It is becoming obvious that State Govts. are starting to clamp down on Gambling or Gaming

lotteries are not exempt however that are regarded as “soft gambling” as the were originally introduced in NSW by Labor Premier Jack Lang as a voluntary way of raising revenue with a reward. The gaming industry has “progressed” as a whole since then.

It isn’t on the cards that Govt’s may even ban credit purchases on some forms of gambling -which if they do -will cause alternative chaos especially unemployment.

We will just have to ride it out as the mixed problem is the Govt. makes huge returns from Clubs -their Pokies etc.

Banning never achieves satisfaction overall, it creates frustration -education and alternatives may offer a solution -I doubt it!

Pingback: Eaton