Officeworks selling newspapers?

I have heard of Officeworks selling newspapers in two locations now. Have others heard of or seen this too? Is there a single publisher making such a push?

I have heard of Officeworks selling newspapers in two locations now. Have others heard of or seen this too? Is there a single publisher making such a push?

The other tweak of our recent magazine relay which we completed on the weekend was moving quilting, cross-stitch, craft and card making magazines to a new location, at the entrance to our women’s magazine aisle, directly opposite our women’s weeklies – New Idea, Woman’s day and the like.

The other tweak of our recent magazine relay which we completed on the weekend was moving quilting, cross-stitch, craft and card making magazines to a new location, at the entrance to our women’s magazine aisle, directly opposite our women’s weeklies – New Idea, Woman’s day and the like.

We have been trialling a selection of these titles near the weeklies and sales were up as a result. I figured that moving all the titles to this high-traffic location was worth trying.

Sales of craft and hobby titles are up 80% or a moderate base. The currently only account for 4.5% of all magazine sales. I’d like to see that increased. Hence the better position for the full range.

We are ensuring that popular Australian titles are given the best position in the display. This is our preference – to promote Australian titles ahead of imported titles.

This move freed up space further in the aisle which have used to improve the display of other categories.

I plan to track the performance of the quilting / craft titles over the next month before making a decision on their long-term positioning.

Looking back at some of my blog posts from 2007/ 2008 we went through a purple patch with magazine cover mounts, tip-ons as some call them – the freebies which publishers stick to covers to help sell their titles.

Looking back at some of my blog posts from 2007/ 2008 we went through a purple patch with magazine cover mounts, tip-ons as some call them – the freebies which publishers stick to covers to help sell their titles.

It seems to me that they are less of a problem today. Or am I blind to them?

Checking one of my newsagencies yesterday, there weren’t that many and those which I did find were professionally done. Take Madison, the free nail polish was handled well.

I’d be interested to know what other newsagents think. Are freebies with magazines less of an issue today.

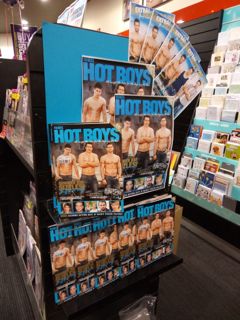

We have been promoting the Hot Boys on TV one-shot with this aisle end display. While not a runaway success, sales are ticking along … here and overseas. I received an email from someone in the UK overnight wanting me to mail them four copies. They got to me through a Google search for the title. It’s not out in the UK. They’re paying full cover price and air mail. I’m happy to oblige.

We have been promoting the Hot Boys on TV one-shot with this aisle end display. While not a runaway success, sales are ticking along … here and overseas. I received an email from someone in the UK overnight wanting me to mail them four copies. They got to me through a Google search for the title. It’s not out in the UK. They’re paying full cover price and air mail. I’m happy to oblige.

Check out this video from Dorling and Kindersley UK. While it was produced to inspire those in book publishing, it is just as relevant to everyone involved in magazine publishing.

Publishers, distributors, newsagents watch the whole thing…

Yes, those of us who rely on print in our businesses face challenges. It we believe that these challenges are a death spiral then it probably will be. The alternative is for us to read the script a different way, to create our own successes.

Based on our sales of People’s Friend magazine, I expect that we could have sold at least five copies of The People’s Friend 2012 Annual. We received two copies last week and both have sold. While we are chasing more stock from Gordon and Gotch, it is frustrating that we were not supplied sufficiently to satisfy demand.

Based on our sales of People’s Friend magazine, I expect that we could have sold at least five copies of The People’s Friend 2012 Annual. We received two copies last week and both have sold. While we are chasing more stock from Gordon and Gotch, it is frustrating that we were not supplied sufficiently to satisfy demand.

I understand that the problem may be at the publisher end in the UK. If this is the case I hope that Gotch has taken them to task as it is disrespectful to the weekly purchasers of their product to not have access to sufficient stock of the annual.

If the problem is within Gotch then they need to look more carefully at these types of add-on items and place them where they do sell. I’d be frustrated if I can’t get more stock and they end up with considerable returns from other newsagencies.

While this is a book size title, we were able to sell it by placing it at the front of the magazine fixturing, with the magazine. I mention this in case readers remember my criticism of The Friendship Book 2012 recently and how the size makes it a challenge to display. At least with The People’s Friend 2012 Annual we are able to locate it with the magazine and reach the target shopper perfectly.

More generally on the issue of magazine undersupply, magazine distributors can report to publishers on lost days. They know the quantity they supply per store, they know sales and especially the date and time of sale of the last copy. This enables them to calculate the on-sale days for which each store did not have stock of any issue of a magazine. I wonder if distributors provide this data to publishers.

We have started work on expanding our offering of gardening magazines. The first step was to move the segment to just below our weeklies. We did this on the weekend. While customers have to reach down to purchase these titles, we think they will. The titles will certainly be noticed because the weeklies are located above – out of shot in the photo.

We have started work on expanding our offering of gardening magazines. The first step was to move the segment to just below our weeklies. We did this on the weekend. While customers have to reach down to purchase these titles, we think they will. The titles will certainly be noticed because the weeklies are located above – out of shot in the photo.

We are working on our range of gardening magazines by ordering titles we want. Any magazine distributor people reading this – this post is NOT your cue to sign us up for whatever you think. We will do with this category what we have done for food – the results of our work over several months there speak for themselves. Brilliant … unit sales are up 100% year on year – well ahead of the channel trend.

I was asked last week by a newsagent why we spend so much time working on magazines if they are a declining category in the business. Our work on magazines is focused on sales today and in the short to medium term. I think that well run newsagencies with a professionally managed magazine offer have an opportunity to grow sales. So, there is a financial return for this attention. I am seeing this and this is what drives my attention.

Newsagents who treat magazines poorly and delegate responsibility to someone with little of no skin on the sales outcome will see sales respond to this.

Check your prejudices, biases and other baggage at the door and think about the retail business which you consider to be the BEST.

Think about why you consider them to be the best. Break down their business in your head. In doing this, look for opportunities to mirror what they do. Their success often comes down to relentless pursuit of their core business principles / values.

The Reject Shop – value; David Jones – aspirational, quality; Boost Juice – healthy; Zara – cheap fashion; Smiggle – fashion stationery.

This tip is another way of saying spend time pursuing your Unique Selling Proposition. Being a general retailer without an obvious and valuable USP is not good for any business.

Paid Content has published a report about the success of the publishers who were the early adopters of the new Apple digital newsstand platform. Newsagents should read this.

The success of the newsstand platform, even though it is only in its early days, will draw attention from more publishers.

This is what we need to watch and be aware of as it will impact our longer term business plans. We need to be aware of any moves to digital of products which we sell in our businesses … as I’ve written here for years.

There are two key contexts of concern: how magazine distributors deal with us through the transition and what we bring to our businesses to respond to the challenge of digital.

Further to my post last week about moving newspapers away fro the counter and further into the newsagency, we have not seen a decline in newspaper sales as a result. If anything, we are experiencing an increase in sales. We’re two weeks in and will continue to monitor the impact.

We moved a bunch of products during the week including this range of items targeted it kids.

We moved a bunch of products during the week including this range of items targeted it kids.

In placing these items at the counter, we are targeting kids shopping with parents as well as grandparents who are busy purchasing stocking stuffers for Christmas.

With space very limited, plenty of time is spent each week moving items around – a bit like one of those puzzles we did as kids … chasing the perfect fit.

JB HiFi is demonstrating its care, or lack thereof, for Australia by starting a grey import service of goods from overseas. This service offers products which JB says are the same as what can be purchased from their stores. The difference is that the products are shipped direct to the consumer from overseas, avoiding GST.

While JB will say that they have to do this to counter overseas websites selling into Australia, my take is that their initiative disrespects Australian taxpayers. It dodges their obligation to support Australia, to be a good corporate citizen.

The JB HiFi move speaks volumes about ethics and social responsibility. They are putting their profit goals ahead of the needs of Australia as a country. they are doing this by pandering to greed – theirs and that of those who will purchase through them.

Yes, I want the federal government to address the tax anomaly. However, I understand the challenges of achieving this in a cost-justifiable way as a recent Productivity Commission report discussed.

JB HiFi should work harder to address the issue of collecting tax on items purchased overseas and shipped direct to Australian addresses rather than joining others to deny vital tax dollars which fund schools, hospitals, roads and other federally funded infrastructure and initiatives. Yes, this is a hard road. Equity can be like that. Imagine what life would be like if people always took the easy or greed route.

By helping, and even encouraging, Australian consumers to avoid paying tax JB HiFi disrespects us.

Pens and refills account for 34% of our stationery sales. Stationery for us does not include ink and toner, photocopying, art supplies or papers – each of these has their own department. So, in what we call pure stationer, pens and pen refills account for 34% of sales.

This is pretty good from what I can see. However, the percentage depends on the range of stationery carried. In a high street or rural regional situation the percentage would be lower because of a considerably more diverse range of stationery.

In my newsagency for which I am writing about here, the range of stationery is focused on impulse and every day convenience purchases. We have not stocked the business to be a stationery retailer of last resort. If the majors do not stock it then it would not be valuable of us to stock it in my view. We have very limited (expensive) space and need the best possible stock turn to pay for this.

I am curious as to the percentage of stationery which pens / refills achieves in other newsagencies. I think this figure could be an interesting discussion point … we could learn a lot about how others run their businesses.

I have had several newsagents asking where they can source Dumbo Feather magazine which I have written about here. Network Services has the title even though it is not found on through their website. While not a volume title, it appeals to a valuable and committed niche … well worth stocking if you consider yourself to be a magazine specialist.

We are promoting the latest issue of Real Living with this aisle end display facing into our magazine reading area. We’ll run the display for a week. Our next step is to promote the title in two locations so that it has a next step from when this display comes down. We try and make sure that all titles promoted in a display have somewhere to go after the display. I think this is important as it supports the title before the initial flourish of activity.

We are promoting the latest issue of Real Living with this aisle end display facing into our magazine reading area. We’ll run the display for a week. Our next step is to promote the title in two locations so that it has a next step from when this display comes down. We try and make sure that all titles promoted in a display have somewhere to go after the display. I think this is important as it supports the title before the initial flourish of activity.

We have moved newspapers from the front counter further into the store. We have done this to create a better shopper experience. With sales up our counter was becoming log-jammed and making getting to newspapers more challenging. Also, we have expanded our newspaper product range and at the counter we could not fully display these and make the most of the expansion opportunity.

We have moved newspapers from the front counter further into the store. We have done this to create a better shopper experience. With sales up our counter was becoming log-jammed and making getting to newspapers more challenging. Also, we have expanded our newspaper product range and at the counter we could not fully display these and make the most of the expansion opportunity.

We have encountered some push-back from regular shoppers about the move but that faded after the first couple of days.

Like any move in the business, we will monitor sales and make adjustments if necessary. Our goal is to grow newspaper sales from this store over time. The new location for newspapers should help achieve this by making them more accessible and more easily browsed.

This latest change is another in the various changes we are making in-store, flowing from the magazine relay we undertook last month.

We are thrilled with sales for this Merry-Okee Christmas karaoke microphone from Hallmark. Customers love it. We have ordered more stock to ensure we can satisfy demand.

We are thrilled with sales for this Merry-Okee Christmas karaoke microphone from Hallmark. Customers love it. We have ordered more stock to ensure we can satisfy demand.

What I especially like is that the Merry-Okee product is selling off the shop floor, without any special promotional display or marketing collateral. This speaks volumes for the product packaging.

I also like the product as it extends the reach of the Hallmark brand in-store. This fits well with our focus on branded product as opposed to cheap China product. Brands fit in with a sustainable business plan whereas cheap Chins product will only provide sales spikes.

We are promoting the latest issue of Madison with this display as well as good placement in the regular location for the magazine. This aisle end display is at one of the entrances to our women’s magazine aisle. While not a big seller in in the overall magazine department, it is important in our women’s interest category. Sales lift when we undertake promotional captivity. This is why we are happy to debit the time and space.

We are promoting the latest issue of Madison with this display as well as good placement in the regular location for the magazine. This aisle end display is at one of the entrances to our women’s magazine aisle. While not a big seller in in the overall magazine department, it is important in our women’s interest category. Sales lift when we undertake promotional captivity. This is why we are happy to debit the time and space.

Newsagents should read the report yesterday at Press Gazette about accusations by UK newsagents that The Guardian is trying to steal their customers.

The spat between newsagents and The Guardian has rumbled on after the newspaper was accused of stealing customers from local retailers in London.

Trade body the National Federation of Retail Newsagents (NFRN) has condemned The Guardian’s decision to print a loose insert into a copy of last week’s paper offering direct delivery subscriptions to readers within the M25.

The NFRN claimed it was a direct attack on newsagents providing home delivery services.

It claims The Guardian is trying to “steal” customers through “unfair competition” by offering consumers free delivery, guaranteed delivery before 7am (8.30am on Sundays) and by giving subscribers a free gift worth £60.

This report is timely given the state of play of newspaper home delivery in Australia. It reinforces an understanding of the challenges being faced globally around the newspaper home delivery function.

Another newsagent in Melbourne walked away from their shopping centre tenancy last week. He dropped the keys off at Centre Management and left the building mid lease. The shop was relatively full of stock.

While there is no doubt that newsagents in shopping centres face extraordinary challenges, walking away is not an answer. There are avenues of mediation, especially in Victoria.

Landlords are less concerned about the need for a newsagency today from what I hear. This has been brought on in part by the behaviour of some shopping centre newsagents.

We are leveraging the Junior MasterChef TV Show with the Junior MasterChef board game as part of our Christmas grift product mix.

We are leveraging the Junior MasterChef TV Show with the Junior MasterChef board game as part of our Christmas grift product mix.

This is another example of our commitment to and support of big brands. I see this as vital in newsagency businesses. A brand strategy will deliver more value for us that the alternative – chasing the dissent shops down the path of cheap China product. There is little loyalty in the deep discount space as price is your only differentiator.

While there is a risk that a major will come along and whack you on price for a big brand product, the key is to land the product with some flexibility with which to respond to this. However, it is rare that a major would deeply discount a big brand item for the whole of the season. This is where watching their activity is vital. By choosing your time you can make excellent margins off products like this.

The other value in big brand products like the Junior MasterChef board game is that it is recognisable. This makes for easier shopping, faster decisions.

Earlier this week I published the latest newsagency sales benchmark report.

The first quarter of the financial year lived up to expectations, delivering challenging sales results for newsagents with key categories reporting sales declines.

There was a considerable difference in results for city versus country newsagents with the latter overall delivering steadier results.

A key take-away from analyzing the data from 143 newsagency businesses is that newsagents who work on their businesses reap rewards. This is reflected in department and category sales data as well as sales efficiency: basket size and sales value. The results speak to the importance of focusing on the three critical aspects of retail: customer traffic, average basket size and, margin.

In the all-important magazine department, there appears to be a greater volatility in sales between categories. This volatility is reflected in two ways:

The overall result for magazines in the benchmark study pool is better than I’d expect to see for the channel as a whole because the data is provided by newsagents who care about and understand data. Newsagents who would not even know how to access their own trading period sales comparison data would, in my view, be less likely to care and therefore manage their businesses for sales success.

The group of newsagents delivering the most challenged results, across the whole business, continues to be those in capital city shopping centres. Based on recent closures, it is fair to say that the lure of shopping malls for newsagency businesses is fading. The benchmark sales data shows that achieving the sales growth necessary to stay ahead of the annual 5% (and more) rent increase is challenging. This is made even more difficult by the fixed margin nature of much of what newsagents sell.

Click to here read on.

More detailed information is being shared with participants.

The New Idea Test Kitchen TV show launches this coming Sunday, November 20th. The show is sure to boost interest in the New Idea magazine, especially in the lead up to Christmas. Check out a teaser for the show on YouTube:

The launch of this show is a good reason to give New Idea greater prominence in-store

We have put our iPhone and Android related magazine titles together to make the most of the story we are able to tell in this topical space.

We have put our iPhone and Android related magazine titles together to make the most of the story we are able to tell in this topical space.

The small display is at chest height in our magazine display and therefore quite noticeable. We have situated the display to make it the feature segment of our technology magazine titles.

This is an example of the continual tweaking we undertake of our magazine offer, based on titles we have in-store at any time. We are forever reviewing what we have and considering the refreshed stories we can bring to the magazine department.

We have the Royal Wedding calendar out on display as part of our calendar offer. This is a test of interest in the Royal Wedding earlier this year.

We have the Royal Wedding calendar out on display as part of our calendar offer. This is a test of interest in the Royal Wedding earlier this year.

On calendars more generally, our sales are up 145% for November to date. This is off an excellent sales base last year. 145% growth is excellent. We’re feeling very positive about calendar sales this year. And, yes, there is a calendar Club in our centre with their usual push. Plus we have three retailers nearby selling calendars.

We put our calendar sales growth down to having a good range in a high traffic location and making the range easy for shoppers to browse.

Calendars sales are tracking at 15% of magazine sales. This has been my target ratio of calendar revenue to magazine revenue for several years. It’s a useful target KPI for newsagents.