The performance benchmarks for newsagents published by the Australian Taxation Office are, in my view, inaccurate. I was alerted to this by an accountant who has several Victorian newsagents as clients. He expressed concern at the inaccuracy of the benchmark numbers. I checked the numbers and agree with him.

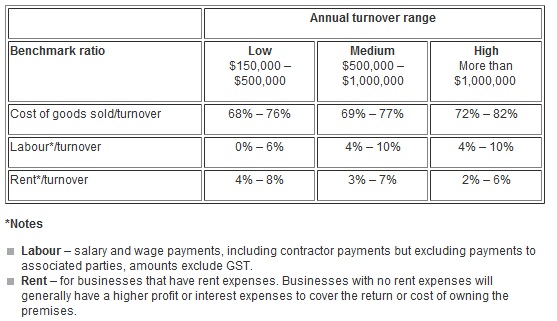

Check out the benchmark numbers against which they are comparing our businesses – remember, they use these numbers to decide who to audit!

None of these figures look right to me. But the ATO being what they will expect you to operate within the benchmarks – otherwise they will audit you. This happened to me. They wanted to know why my rent was more than 6% and why my cost of goods sold was less than 70%. Many weeks and man-hours later they moved on saying that maybe their benchmark numbers were not appropriate for everyone. For no one is more like it.

The audit was a waste of time. It was only undertaken because our rations were different to what they expected. I know that I am not alone in having gone through such a fruitless exercise.

It frustrates me that the flawed benchmarks are widely accessible. A landlord I spoke with recently cited them to counter an argument I was making.

Has anyone else encountered an audit as a result of the ATO benchmark data?

I had to undergo an hour and a half telephone interview with the ATO early last December. They said that we had ‘only minor issues’…a 1% variance in 2 categories (sales/cost of goods sold and rent/turnover). The questions asked required very detailed answers particularly in regard to margins/mark-ups and if/when/why any payments were made in cash and what records were kept. ATO also considered our rent was ‘too cheap’. I had to point out to them that our registered lease agreement had been in existence for over 11 years and all option percentage increase clauses had been agreed upon when the lease was originally signed. Our business is a small shop with a quite large home delivery and subagent territory. I pointed out to the ATO officer that their performance benchmarks for newsagents did not cover newspaper and magazine delivery bsuinesses. He asked where did I get this information from…I told him that it from their very own ATO web page on newsagent benchmarks (3rd paragraph under industry overview). The interview was concluded shortly thereafter. It was quite a ‘draining’ experience. We got a letter from the ATO thanking me for the telephone review and have not heard anything else from them.

What you got was a “review” not an audit. Newsagents are part of the cash economy which is under a lot of scrutiny right now. Although it concerns me that you said “many man hours”, in my experience enquiries into benchmarks have all been resolved in about an hour, the worst case was 3 hours.

The benchmarks are actually quite good. However as everyone knows – benchmarks are just that. The person you spoke to probably doesn’t understand how they are supposed to work (an unfortunate representation of the quality of ATO staff). The ATO has a LOT more information than the published benchmarks.

That’s why you got the call – all they are after is a please explain when you are out of the benchmark range. They are really designed to catch out people who are too silly to realise that “margins” for the better part are known in the industry – sure you might do some jobs for next to nothing but it won’t be the majority.

In your case Mark – the rent being above 6% is a bad indicator (means you should have more turnover for your rent). But it’s really odd they were concerned about the COGS being below 70%, that means you are reporting MORE turnover than they were expecting.

Without knowing your business, but reading your blog the COGS is easily explained by the fact you are good at chasing higher margin profits. But I’m sure there is a reason your rent was higher than average too.

As I said, my experience has been more like Liz. Telephone discussions on why the client is out of the benchmarks with no real followup.

Blake I disagree. The benchmark numbers are quite wrong. They are also poorly structured and do not account for the situation – shopping mall, high street, rural etc. In a shopping centre, the current occupancy cost benchmark is between 11% and 13%. This is a landlord benchmark and rent adjusts to achieve this, often more.

My issue is that I wasted hours trying to convince them that I was not doing anything illegal – because their benchmark numbers are wrong.

Hi Guys,

These may be good news for me… We have a market review review due in June… and want our rent reduced considerably… this could be another tool that we use to argue our case – after all we are paying much more than we should …

A 300% + increase in rents over the past 4 years, foot traffic down, vacancey rates in our centre are high (and have always been), and yet rateable value of residential properties in the area have reduced by 20% over the same period…

Cheers

Peter

My accountant was also concerned that my business was way outside the benchmark. I said that absolutely evertthing goes through my books and the POS system so just lodge my return and see waht happens.

yes i got audited last year too. i sold over $1 million of bus tickets which is more than 50% of my main sales other than lotto. how can i have margin over 20% ??????? unless i don’t declare bustickets turnover only the comm like Lotto

Call me stupid, but why would i put a Dollar in my pocket when it is potentially worth up to 4 times that amount when i want to sell??????

I had to provide every invoice, till printout and computer record for a 3 month period. These filled several boxes. After several months I received a short note saying that no further action is required. All aparently because my business fell outside the benchmarks.

The ATO (Govt) went after the miners and got their arses kicked with the failed mining tax, they then went after Paul Hogan for his money and the got smacked again, they look like getting their bums handed to them over the carbon tax so to make up for all the short falls they go after the only people that still roll over and cop it SME’s.

And no one seems to care in Canberra because we are all individually owned and do not have the $$$ to fight back.

today’s fin review has an article about how the ATO is gearing up audits of SME’s because we are the easy targets.

Interesting comment on the Bus Tickets & Lotto.

For our client with a newsagency – our advice (confirmed by the ATO) was that on agency sales only the commission should be treated as “income”, not gross sales less purchases.

Where it gets confusing is that you need to look at individual contracts to work out exactly what is an agent relationship and what isn’t.

Also on Mark’s note – this could be a very different point on each newsagency’s P&L / tax return. The benchmarks will be wrong if different agents are handling their accounts in different ways.

One other think Mark – our client is in the same boat as you, rent is too high for the benchmark, cogs are too low for the benchmark. Wages are just in, but on the high side. No benchmark review yet.

Mark

I am a signed up member to the organaisation that provides those benchmarks. (It is online.) I have shared it with people but always with a caution:

They are generated by accountants who agree to share their clients’s data with the organisation and anyone who is a member of the site who actually processes a set of financials through the application has their financials added to the benchmarks after the company ‘washes’ the numbers.

Many of those numbers are waaaay off. (I think there is a skew to the country areas, which may explain the rent variation. The company originated – I think – from a ‘country university’. (I don’t want to share the name and promote/ bag them without 100% certainty.)

Any newsagent who is in an urban (professionally managed) shopping centre paying less than 12% can consider themselves lucky.

HOWEVER.

The point about benchmarks is to consider the comparison and UNDERSTAND why your numbers differ.

A benchmark is a standard you aspire to.

These numbers are just averages form a database.

These benchmark numbers are so out of whack that they should be discarded immediately by the ATO and ignored by newsagents.

Hi Mark,

Yes, I agree… and yes they have probabaly come out of Armidale (NSW)…

However, as I have a market review due, and a landlord that wants to further increase rents (after having done so by over 300% over the past 4 years) then I will leverage to my advantage when I go to arbitration…

If I can show that 4 years ago I was in the rental for a medium shop within the 3% – 7% range, but am now paying 15% – 20%, I will play that card, along with other data to support…

We have to use what is npublically available to our advantage… after all we have lies, lies, and how we present data…

Cheers

Peter

I have spoken with two neighbouring business owners who find themselves under review by the ATO under the same pretense (“benchmarking”). These are businesses in two different industries, but both are small businesses who have apparently fallen outside their industry ‘benchmarks’ according to the ATO. I’m sure these aren’t the only small businesses in the same predicament, either, but the ATO apparently thought them soft targets

TO Luke

As an accountant for over 30 years, I once complained to a client/government minister of how Keating’s 1985 tax changes were increasing my costs.

His reply was simply, “So what, increase your bills”.

Guess whose bills rose the most!