Newsagent disinterest in the latest newspaper cover price increase is telling

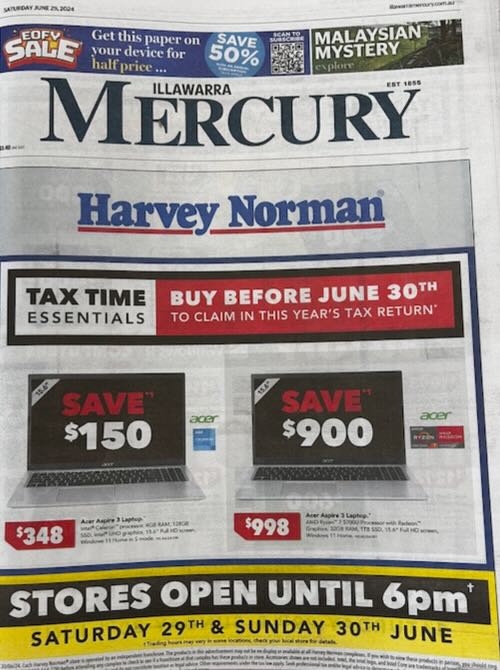

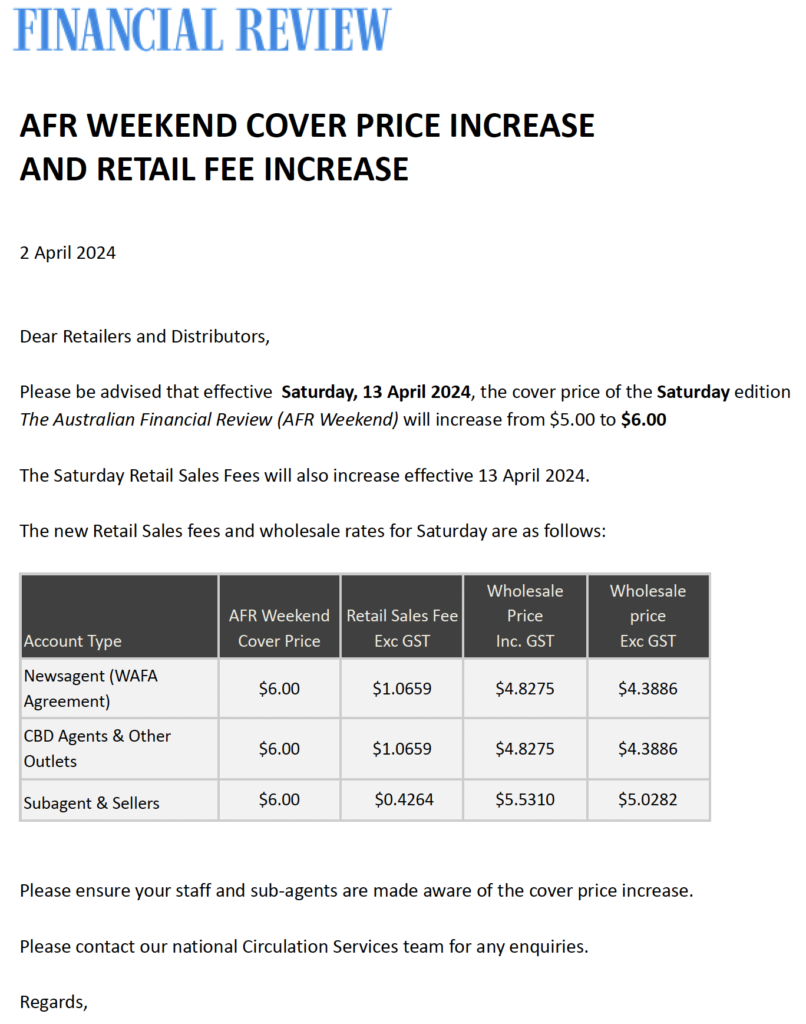

The recent increase in newspaper cover prices might have once been a significant event for Australian newsagents, but today’s reality tells a different story. While publishers are adjusting prices to manage a “soft landing” amidst declining sales, the impact on the retail frontline is minimal.

Before I get into my thoughts, be sure to read James Manning’s terrific piece at Mumbrella today: 4 cents to 5 dollars in 60 years: As cover prices go up, newsprint’s time is running out

A shift in revenue focus

Historically, newsagents were keen on cover price increases because their income is based on a percentage of the sale price. In the past, when prices remained static while labor, rent, and operational costs rose, the only way to increase revenue was to sell more physical copies. This was always hard. Given the current market, that is not viable at all.

With over-the-counter sales declining by roughly 10% to 12% year-on-year, a price hike is technically welcome, yet its practical effect is negligible. For the average newsagency, the latest price increase likely adds no more than $2 to the weekly bottom line. This small gain does little to offset the rising costs of doing business.

Managing the decline of print

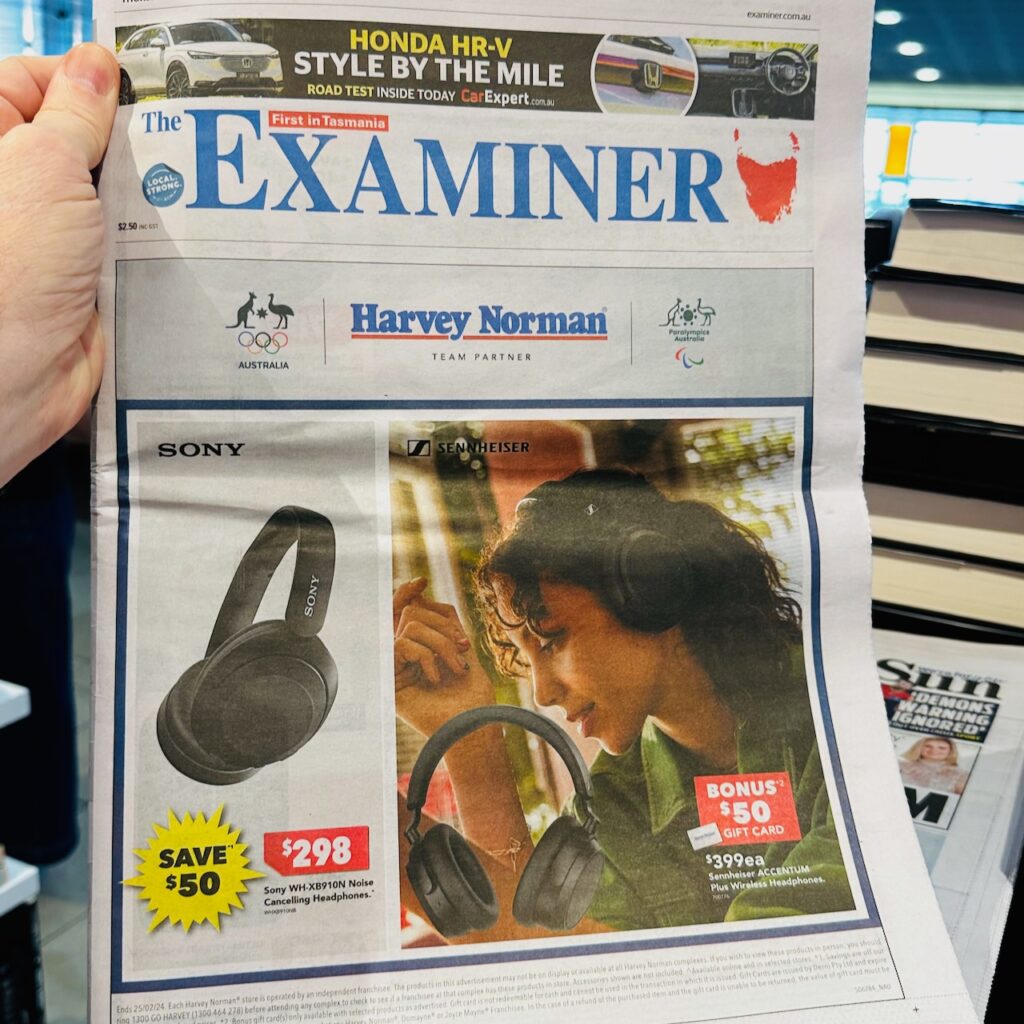

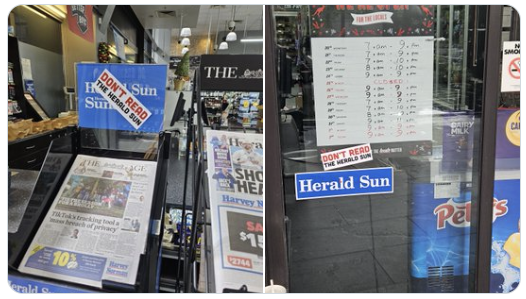

The lack of concern from newsagents regarding these price changes reflects a broader shift in the industry. Like the publishers themselves, newsagents are now focused on managing the steady decline of print media. Many stores have relocated newspapers to the back of the shop, prioritizing more profitable categories for premium floor space.

The current system for managing the supply and return of newspapers is often seen as broken and labor-intensive. Publishers have shown little interest in modernizing these outdated management practices. Consequently, newspapers often fail to “pay their way” when accounting for the space they occupy and the labor required to handle them.

Looking toward the future

The industry has reached a point where a newsagency’s survival depends on its ability to diversify. While newspapers remain a part of the product mix, they are no longer the foundation of a successful business model.

Any newsagent still relying on newspapers as the primary driver for their future growth is facing a difficult path. The real focus today is on evolving the business beyond the traditional print model to ensure long-term sustainability.

How do you manage newspapers today in your newsagency?

Here’s my advice:

- Place them in a low-cost location in-store, likely toward the back of the shop.

- Don’t participate in publisher promotions.

- Don’t promote newspapers on your social media.

- Don’t put p promotional posters.

- Take newspaper branding off your shop.

- When the losses from newspapers are at a concerning level, stop stocking them.

Newspaper publishers don’t care about Aussie newsagents. They will say they do care. Their actions say otherwise.