My thoughts on The National Retail Federation’s Retail’s Bg Show in New York this week

I walked NRF’s Retail’s Big Show through two lenses: as a local independent retailer, and as someone who founded a POS software company in the 1980s specifically to serve that community.

I enjoyed the energy of the floor and the sessions, including the AI deep-dives at the Snowflake Stage. But for a conference dedicated to retail, there were an awful lot of non-retailers telling retailers how to run their businesses. The marketing spin was in overdrive, desperate to sound “empathetic” to capture attention. In exhibition halls loaded with that much hype, it becomes hard to hear anything at all.

Too often, I found myself listening to noise and hearing nothing.

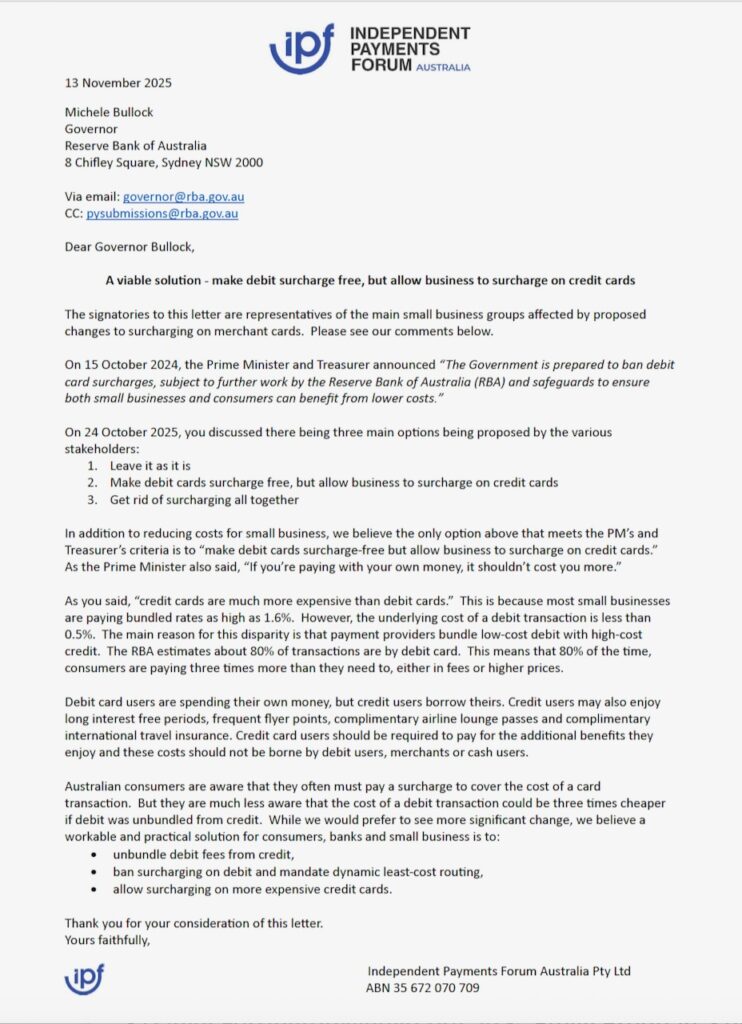

AI is the pitch of the moment, but asking a specific question at a booth rarely yielded a meaningful answer. Too many reps have mastered the jargon but haven’t touched the facts. Interestingly, I saw several companies pitching “new” AI tools that we at Tower Systems actually delivered a couple of years ago. It’s a good reminder that we are still ahead in this space.

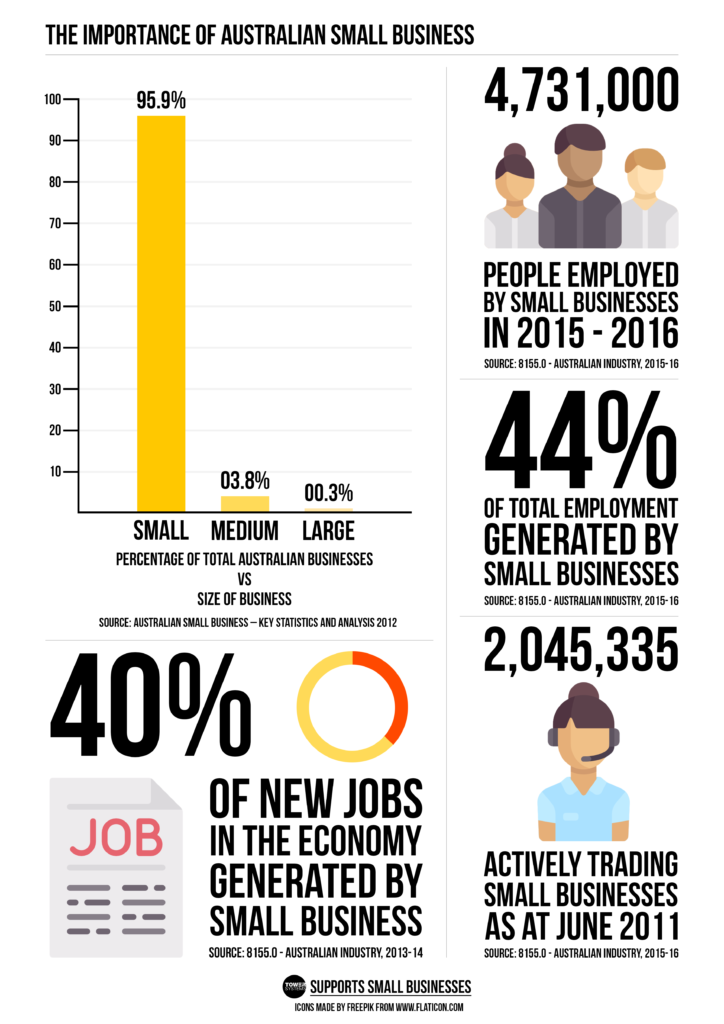

On one of the days, I walked the halls specifically looking for “neighbourhood,” “local,” or “independent” retail. I couldn’t find it. The floor was dominated by tech giants spending millions in pursuit of the next enterprise deal. I suspect the “local” pitch was missing because winning those customers is hard work. It’s done store-by-store, requiring specialised tools tailored to the unique way independents actually operate.

Reflecting on the show through my retailer eyes—informed by my own shop, several e-commerce sites, and a marketing group of 190 independent retailers—it’s clear that national chains are betting on tech to “manufacture” a better customer experience. They seem to think smarter tech and AI can replace genuine engagement.

They’ve forgotten that retail is personal. AI is no replacement for the authenticity of a local shop. That’s our competitive advantage.

I have gone to overseas retail-focussed trade shows for many years as I find I can discover trends before the reach Australian shows. This trip delivered again, but I’ll leave some of the more commercial insights for my work with newsXpress and with Tower Systems. This post here today is more a reflection on the context of big business focus versus local.

Here are a few photos from the hundreds I took at NRF.

…

Mark Fletcher founded newsagency software company Tower Systems and is the CEO of newsXpress, a marketing group serving innovative newsagents who continuously evolve their businesses to be enjoyable, relevant and successful. You can reach him on mark@newsxpress.com.au or 0418 321 338.