The surcharge free movement in Australia is growing momentum. So much so that newsagents charging a surcharge for the use of a credit or debit card will face even more pressure than before.

While I don’t charge a surcharge in my newsagencies, I know of plenty who do. Given the 6% commission on lottery products or 2% commission on transport ticket sales, a surcharge is necessary for many transactions that would otherwise be loss-making.

There is no future for a retail business that sells goods or services where it does not even cover operating costs.

However, Surcharge Free is a thing, a movement … apparently funded by American Express, surprise surprise – and they are using consumer advocate and former Choice spokesperson Christopher Zinn as their public face.

Check out this video:

This video from House explains the retail business value better.

From a newsagency business perspective, the House story does not connect as they control their prices and therefore their margin. Agency focussed newsagencies do not have this luxury. Newspapers, magazines, transport tickets, lottery products, phone top-up … they are all sold at a fixed price with a fixed, small, margin. It is these products that are problematic when it comes to credit and debit card surcharges.

Here is a video from tailor Germanicos:

Again, a product where the retailer controls their margin.

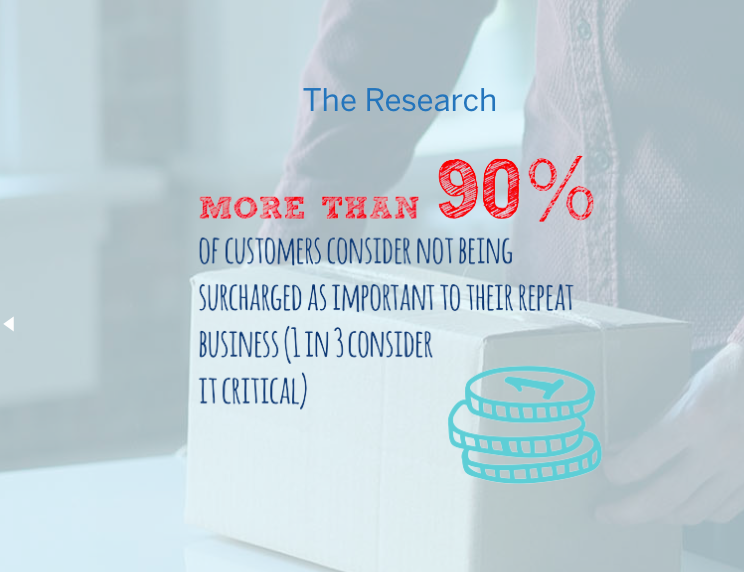

All these videos are from American Express. The surcharge free website is full of data, presented well, that encourage retailers to confront the challenge of surcharge free:

And if that is not enough, there is this:

My own view is that a surcharge in retail is a point of friction. It is an invitation to a shopper to shop elsewhere. It has them wondering where they could shop next time – yes, to save a few cents. They do not care about your margin situation.

So, what do you do?

One option is to pull back on low-margin agency business. I think that is the smart move. It is happening naturally with transport tickets, lottery products, mobile phone recharge and phone cards – with suppliers of these pushing online purchases aggressively. But I know this is easier said than done with many newsagency businesses relying on agency business for more than 50% of foot traffic and revenue.

The other option is to grow non agency business, higher margin business, to fund the credit and debit card fees.

The other option is to charge a surcharge. However, I think that will only end badly for the business given the forces being rallied against surcharges.

I do think shoppers see it this way: no surcharge = better customer service.

My advice to small business retail newsagents is to think through carefully what is best for the long term health and value of your business asset, do not apply a surcharge without thoughtful consideration.

I don’t have a surcharge and I don’t accept American Express. The merchant fees on Visa/Mastercard are tolerable Amex’s fee’s are excessive. I’ve never turned down an Amex card were the customer has walked away, they inevitably pull out a Visa or MC instead with no complaint.

The RBA esitmates it cost around 2% for businesses to handle cash – insurance / time counting / banking / theft etc. Retailers don’t charge a surcharge for handling cash – so why for credit cards? Even Amex has offers for small business as low as 1.33% – well below the 2% it costs to handle cash. Domestic premium & foreign c/cards are generally all higher than Amex. This fact for me was what made it easier to remove all surcharges in my business. Having said that – like Mark indicated – I no longer sell agency type lines like bus tickets and phone recharge and will likely walk away from Lotto when push comes to shove if they try to force a refit onto me. There is no future in agency type lines and any newsagent that isn’t planning for this will be left behind imho.

Never had a surcharge. Do not take amex but amex owners always have a backup. Just 3 weeks ago I have removed our minimum amount for eftpos. This was due to a new competitor who has a $5 limit, as we did. Now we have no limit we see more smiles and even a couple more sales for small items (so not v profitable).

the banks may fund this movement to increase eftpos and Cr cards usage. where is the movement no merchant fee? small businesses are always victims of the big businesses. Pathetic

So when can we expect Tower Systems to remove their surcharge on invoices? 2% for MC/Visa and 4% on Amex.

Leon, the surcharge does not exist for online purchases nor does it exist for billable calls or a raft of purchases. It does exist for system purchases and for support paid annually. In both cases, EFT payment is fine and has no such fees. The company takes a fair approach to the surcharge. There is no reason to penalise all customers for those who prefer the more expensive credit card payment method.

4% for Amex?

Leon – if you are genuinely concerned contact Amex, they have processes to resolve surcharge concerns.

Based on the current Amex fee charged to the company it will drop to 3%. It is the least used card. Also, as noted, there is no charge for EFT.

Of course it’s the least used. Adding 25% on top of what most consider the upper limit for Amex will directly impact usage (amongst other things)

Neil 25% was not added.

You’re correct, I shouldn’t do late night math.

It would be a 33% increase if you charge 4% when it’s 3%

Neil, 33% was not added. You don’t know the Amex fee to the company. The new fee of 3% reflects a review of the fee. No conspiracy here. Plus – people can pay by EFT for no fee.

I have never understood why there is a flat fee for EFToPos but a % for CC. The cost to process the transactions should be the same.

The banks can, and should,r educe their charges as the growth in the use of cards has given them increased economies of scale.

The card USER should be the one to bear all the fees, the costs of using their card. The retailer should pay a simple fee to cover the actual processing costs and a reasonable profit margin and no more.

Choice has just awarded Amex a 2016 shonky award for “spruiking a surcharge free campaign while having one of the highest-fee cards on the market”. The news put a smile on my face.