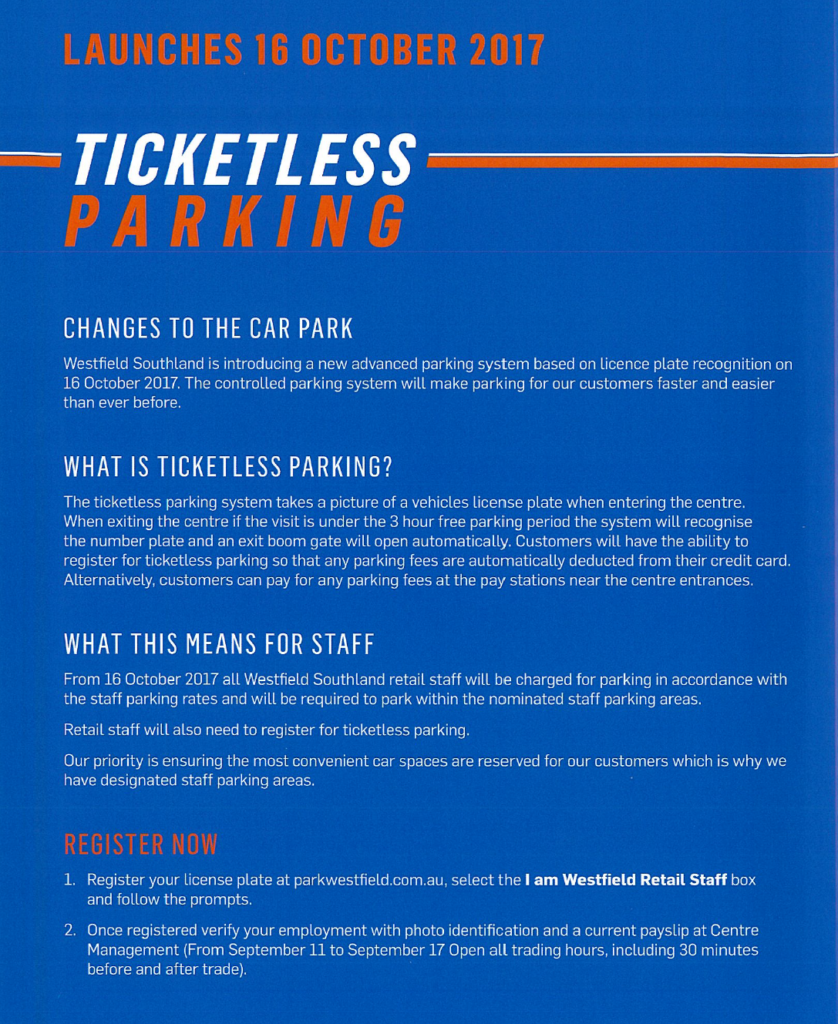

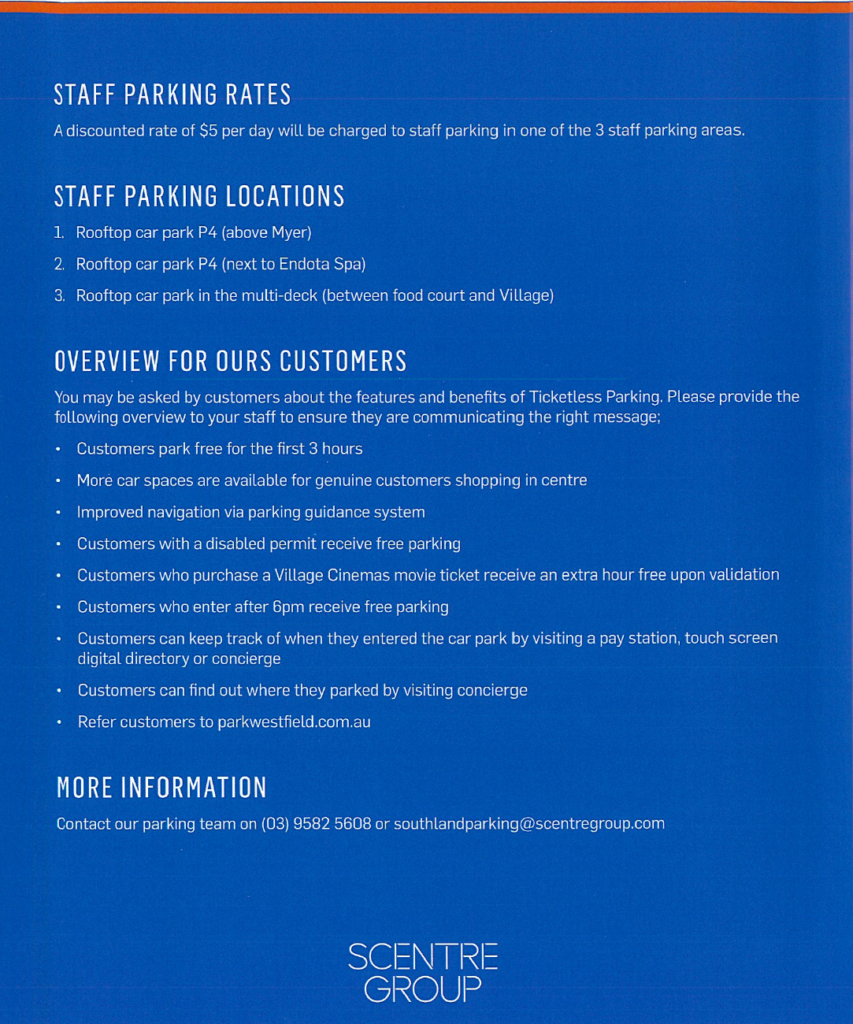

Here is the announcement from Westfield yesterday to business owners and employees at their Southland centre. This move to charge for parking is a tax of retail workers and a tax on small business owners.

For the record, my business there will pay the parking fee for full time staff and those working two shifts or more Monday through Saturday.

The same parking conditions have just started at The Towers Castle Hill NSW

What do you think about it Leon?

When our centre was redeveloped 5 years ago they introduced a ticketing system with $4 staff parking. Paying over $500k a year rent but it still used to grind on me paying $4 parking to them so I moved my shopping centre storage to a unit across the road from the centre which came with 2 parking bays.

Will provision of free parking be a taxable benefit if so will need records which staff use and how many days.

Seems a fairy generous system, have seen far worse in operation.

Colin Yes I believe it would be seen as a Fringe Benefit and Taxed as such (an add on to employees wages I think). Mark you have an accountant who should be able to answer this query.

It all depends on how it is paid and recorded.

Using the word “tax” is emotive and literally wrong.

Why should Westfield shareholders be paying for unproductive space in their business?

Would you let some third party take up 10 – 20% of your shop area?

Big Oil the tenants entered into lease agreements based on a set of processes and known costs. Employees in the businesses too. They have changed. I don’t think your example matches what has happened here.

I put ‘ around tax. I call it a tax because it is a surcharge on top of agreed costs.

So if it is raining heavily then expect all customers to be served by drowned rats! What are the WHS implications or car safety issues with all staff cars being in the same outdoor parking area.

I really do not like my landlord but I am happy his name is not Westfields

Westfield centres tend to have public transport hubs nearby, if not integrated into the centres. This leads to commuter parking taking away from customer parking issues and the only way to deal with it is parking charges for longterm parking. I can’t see why you’d reimburse employees for parking charges as low as $5 a day when other employees are probably paying more in public transport fares. Are they being reimbursed as well. This is a reason why it’s considered a fringe benefit.

Probably the easiest way to avoid the FBT issues is to increase everyone’s pay by $5 a day. The business can claim the tax deduction as wages and the employee pays any tax owed (most won’t be able to claim deductions against it) and every employee is treated the same.

Most customer confused about how it works.

I don’t like it but I agree with Pat. It’s done to stop daily commuters taking up a parking spot for the day.

Blow’s my mind how car parks can allow this to happen. Clearly price gouging, I wonder if the ACCC has an opinion on this?