Growth in the number of likes for your business Facebook page(s) is as important as growth in shopper traffic through your front door.

I see a direct correlation between the two, if you use Facebook well. Of course, if is the important word in that statement.

I have been actively using Facebook for business for many years. It is an excellent platform of reaching new customers and talking with existing customers. It is an important tool in business growth.

HOW DO YOU GET MORE LIKES ON FACEBOOK?

This is simple, provide good content, content that gives people what they come to Facebook for – entertainment, inspiration, a laugh. The more you do this the more your post will be liked and shared. The more likes and shoes the more people you reach.

Growth in likes for your page begins with your content. If your page likes are not growing, look at your content.

While you can ask people to like your Facebook page, resulting likes may not be as valuable as those who like your page of their own accord.

You can also buy likes. That, however, is a waste of money.

HOW DOES A BUSINESS USE FACEBOOK WELL?

Businesses that use Facebook well entertain. This can be by making people laugh, smile, feel emotional or be happy overall. They do it by being human, real and engaged. They do it by not trying to sell. They do it y not being commercial.

Photos are real, not studio shots, showing products in use more so than on the shelves. They show customers, happy customers.

They share something of themselves.

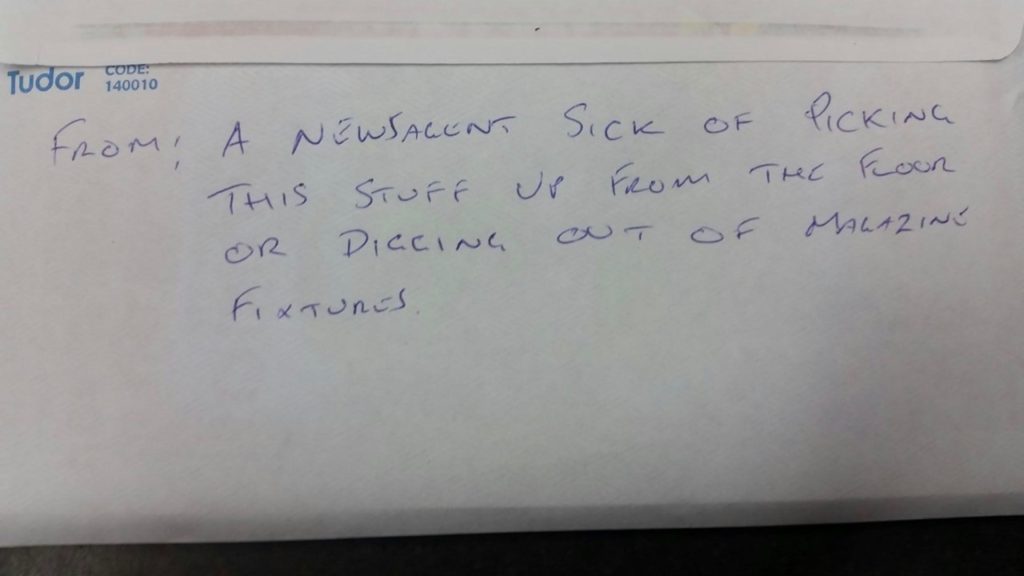

A newsagency uses Facebook well by not writing about products newsagents sell.

HOW DO MORE LIKES OF YOUR BUSINESS TRANSLATE INTO MORE SALES?

Someone engaging with your business Facebook page is similar to someone browsing your shop. Both can lead to sales.

People being on your page and engaging with your page brings them close to you and proximity = sales.

The more people who like your business Facebook page the more people you can pitch and offer to or reach out with an event or product announcement, them more people who will hear what you have to say.

Take Facebook seriously as a key business tool. The benefits are real and valuable.

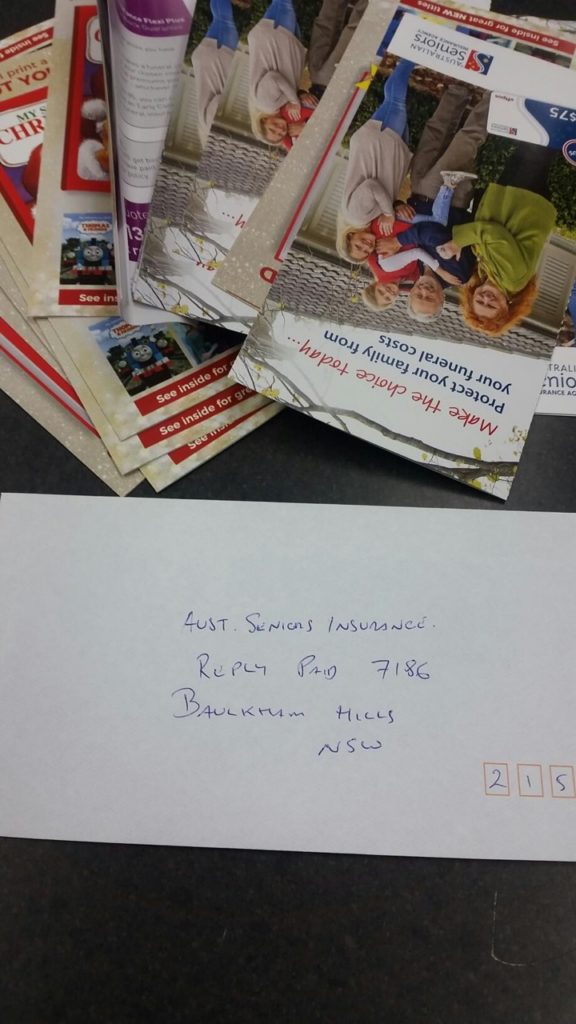

We love the reaction to this social media post pitching a card. It’s the type of post I was referring to when I wrote abut Facebook recently. It connects emotionally with Facebook users.

We love the reaction to this social media post pitching a card. It’s the type of post I was referring to when I wrote abut Facebook recently. It connects emotionally with Facebook users.