Twice yesterday I experienced a surcharge being added to a purchase, in different retail businesses. In each case, the amount of the surcharge was not revealed until after I had presented the card and in each case the receipt I asked for did not include the surcharge.

Both businesses were selling items over which they had price control, good margin items.

Ian the first purchase I didn’t;lt notice the amount on the credit card terminals, and the staff member could not tell me the amount of the surcharge, only that there was one.

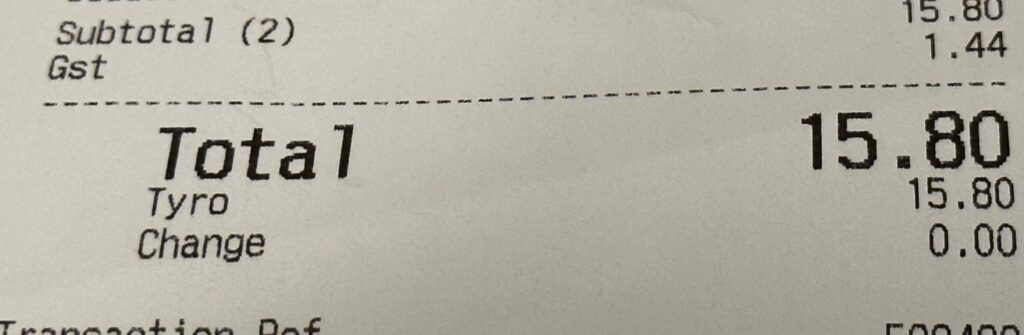

In the second situation, I saw that the surcharge was 8 cents as it showed on the screen, but it was not on the receipt from their POS software.

Applying a surcharge where the items have good margin and where the business can set prices does not make sense to me. It turns me off these businesses.

A bigger problem thous is the poor service of not adequately disclosing the amount of the surcharge and not documenting it on the copy of the receive they provide when requested.

If I was competing with these businesses their current approach to surcharges exposes a weakness that I’d, for sure, exploit.

I get that retailers don’t like credit card fees. At less than 1% of purchase value, they are a low cost compared to other business costs. For example, I suspect the 1% cost is considerably lower than the cost of theft in the business.

To me, a credit card surcharge applies a cost to a business service that actually has time saving and other benefits for the business.

So, yeah, I don’t like it, and I especially don’t like that it’s more often used in independent local retail than our big business competitors. The last thing we need is giving shoppers a reason to preference big retailers over our local indie retail businesses.

Too often, local indie retailers are grouped together on things like this, and that worries me – that enough local indie retailers apply a surcharge for card use to have some shoppers think we all do it.

I get that some want a way to recover the cost of card use.

- Look at your prices. If you don’t round to .99, do it.

- Look at your prices. Add a couple of % to markup on items that you can.

- Reduce the value of the loyalty discount you offer.

- Ask your card processed for a rate review.

- Look at your dead stock. In plenty of retail businesses the cost of dead stock is a much bigger burden on a business than card processing fees.

My point is, applying a surcharge is easy and, I am sorry to say, lazy. There are other moves a retailer can make to claw that cost back.