When 2020 began

When 2020 began, we were in the dark about what was coming for us, for all of us. We had our resolutions, plans and hopes. We had our cherished dreams.

We were unprepared for how 2020 would play out.

The hopes and dreams we started the year with were soon forgotten as the pandemic took over the news, our businesses, our home life and our focus.

2020 sure has been a year.

Looking back, we see heartbreaking human loss and economic challenges, which, sadly for too many, continue today.

Looking back, we also see many wonderful achievements.

There are the big pieces like the 1,000s of scientists working together to create vaccines in record time, people and businesses fundamentally changing how they work and politicians, for a moment, setting aside traditional differences to actually do good.

There is the good news of whole communities working together to ensure people remain safe and to get the numbers down.

In small business, where we spend much of our time, we have seen wonderful acts of kindness, extraordinary local shopper support, greater resilience and deeper community connections. It has been a joy to hear stories of locals consciously shopping locally and genuinely being interested in product sourcing.

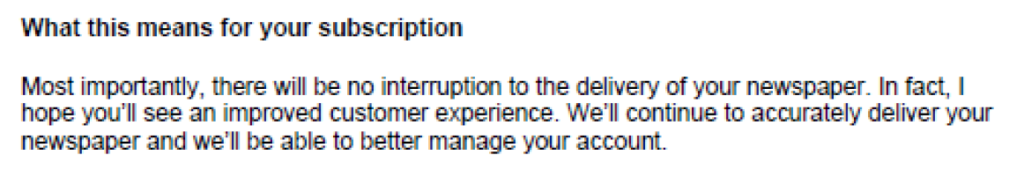

We have all learnt so much about ourselves this year, what we can do, the differences we can make, new friends we can serve.

As the sun sets on 2020, we are grateful for this year, for the opportunity to be part of it and to be here, at the end, stronger and grateful for what 2021 will offer.

Happy New Year. May your 2021 be healthy, happy and filled with gratitude.